Do I Need A Mileage Log For Tax Purposes Do I need to keep a Small Business mileage log Keeping a mileage log is essential for various situations Especially if you aim to claim mileage deductions on your

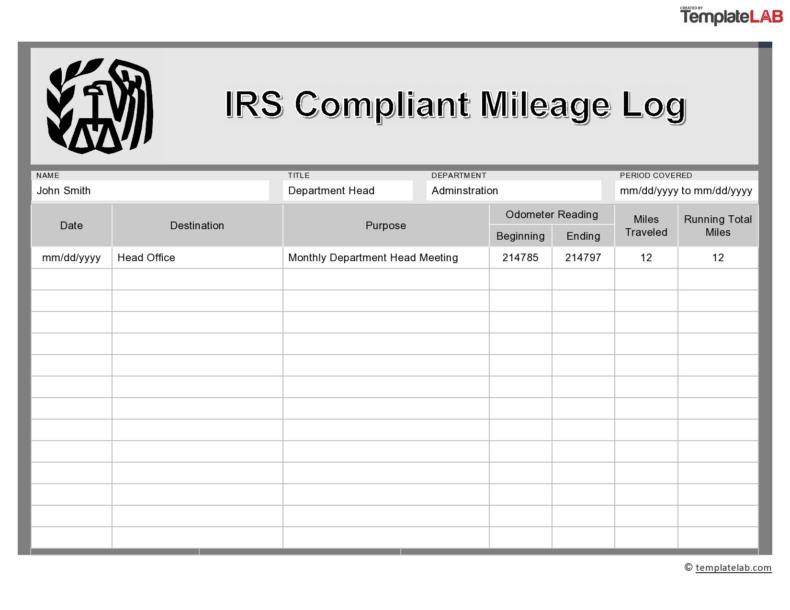

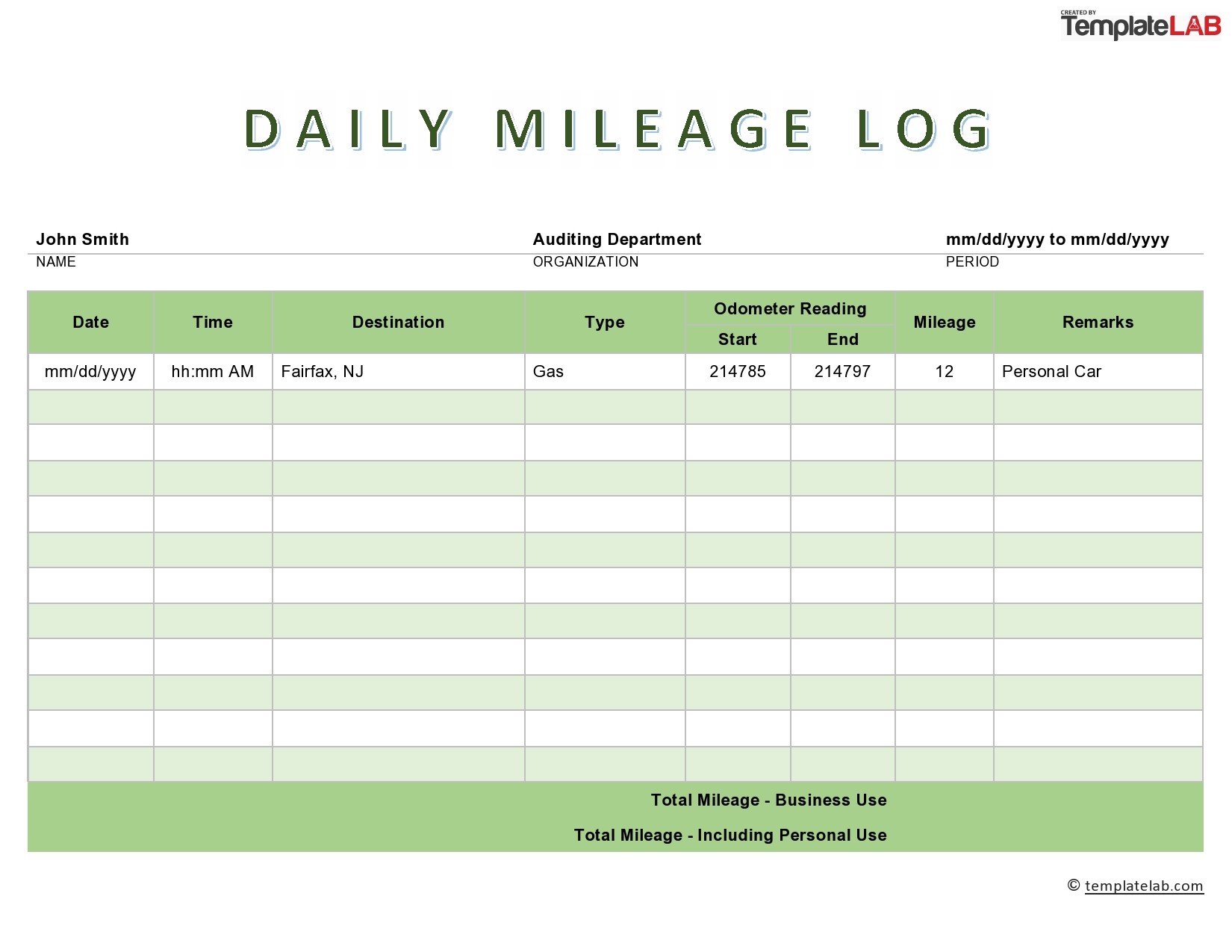

For Standard Mileage Rate Keep an IRS approved mileage log If you decide to go with the standard mileage rate as most Americans do you ll need to keep a mileage log If you use your personal vehicle to conduct business and plan to take tax deductions on your mileage or you re an employee getting reimbursed it s important for you to understand the necessary various record keeping

Do I Need A Mileage Log For Tax Purposes

Do I Need A Mileage Log For Tax Purposes

https://i.ytimg.com/vi/xzM5F4GxzIs/maxresdefault.jpg

:max_bytes(150000):strip_icc()/IRSSampleBusinessUseofCarLog-c0287e173350497e99732f429aae2305.jpg)

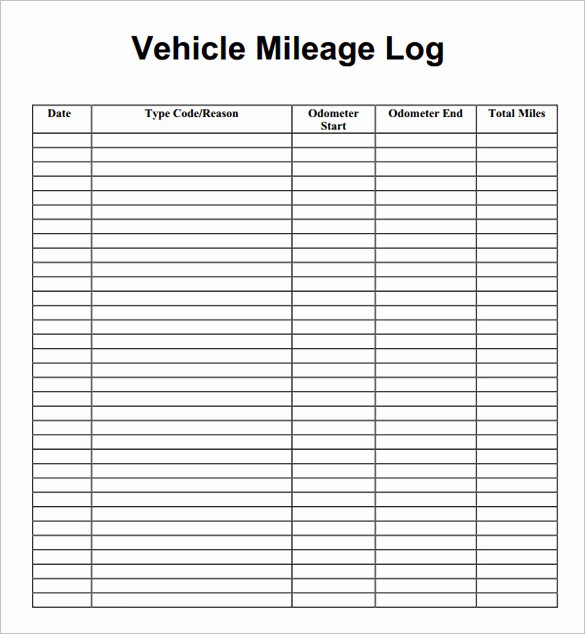

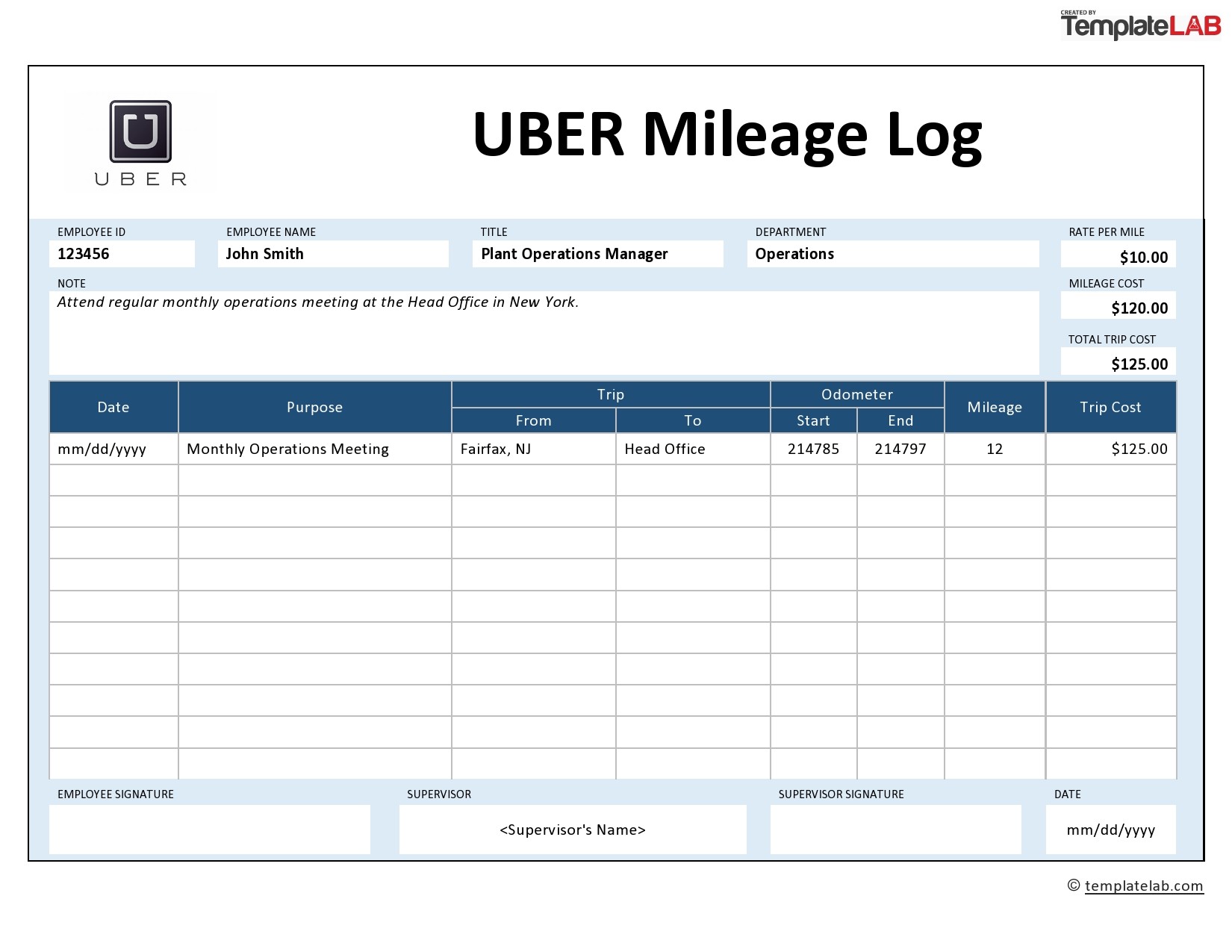

Vehicle Mileage Log Editable Excel Worksheet Employee 56 OFF

https://www.thebalancemoney.com/thmb/MCVvUIjSF3IsMCii1cFwZC_UmcA=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/IRSSampleBusinessUseofCarLog-c0287e173350497e99732f429aae2305.jpg

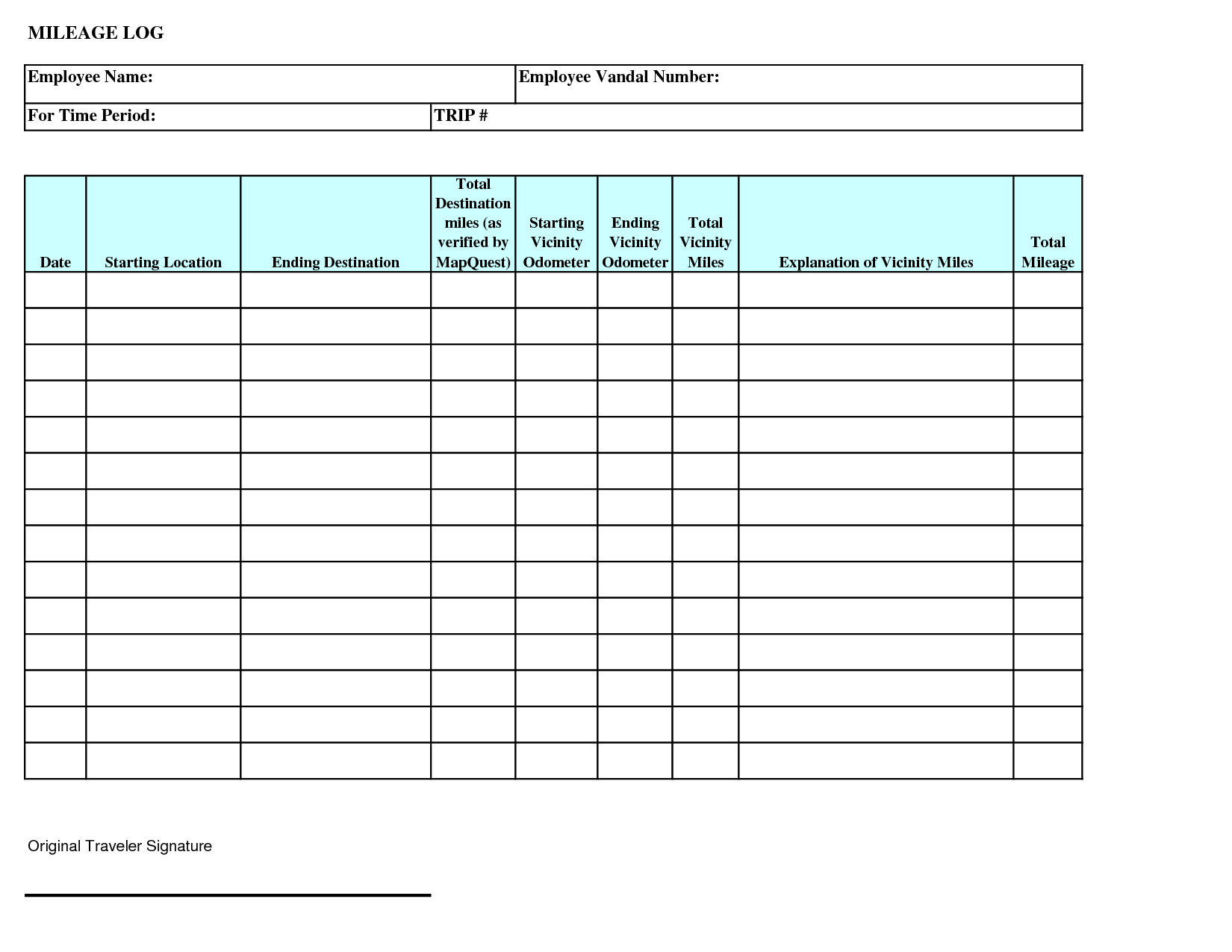

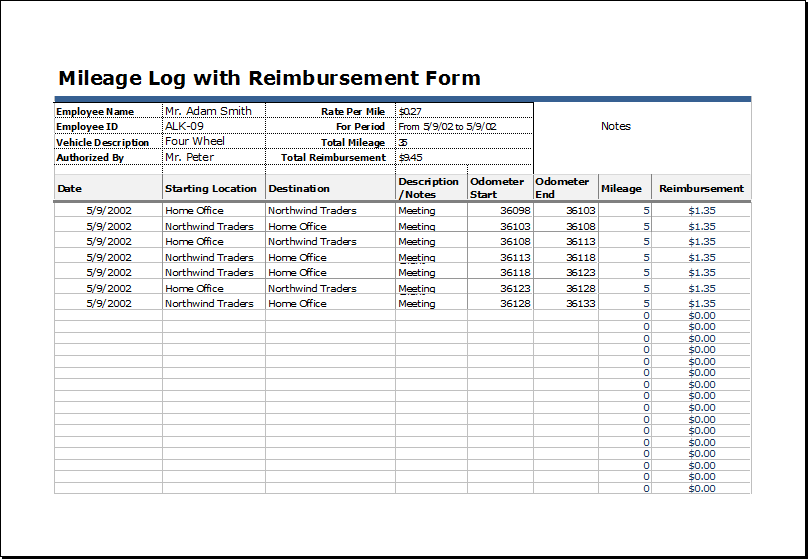

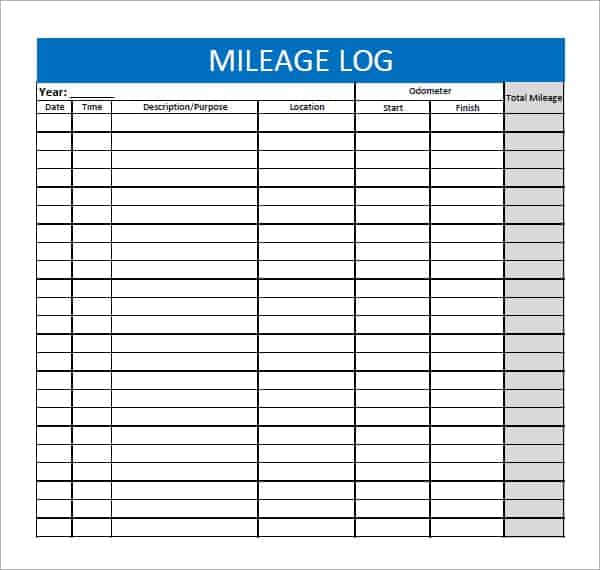

25 Printable Irs Mileage Tracking Templates Gofar Self Employed Mileage

https://i.pinimg.com/originals/90/c4/72/90c472507abb4717074a59c5f8ec99a0.jpg

Keeping a compliant mileage log can be the difference between ensuring you receive the maximum tax deduction for your mileage or missing out on the money you re If you deduct mileage on your business taxes you need to know the IRS mileage log requirements Discover best practices and how to automate tracking for accurate tax deductions

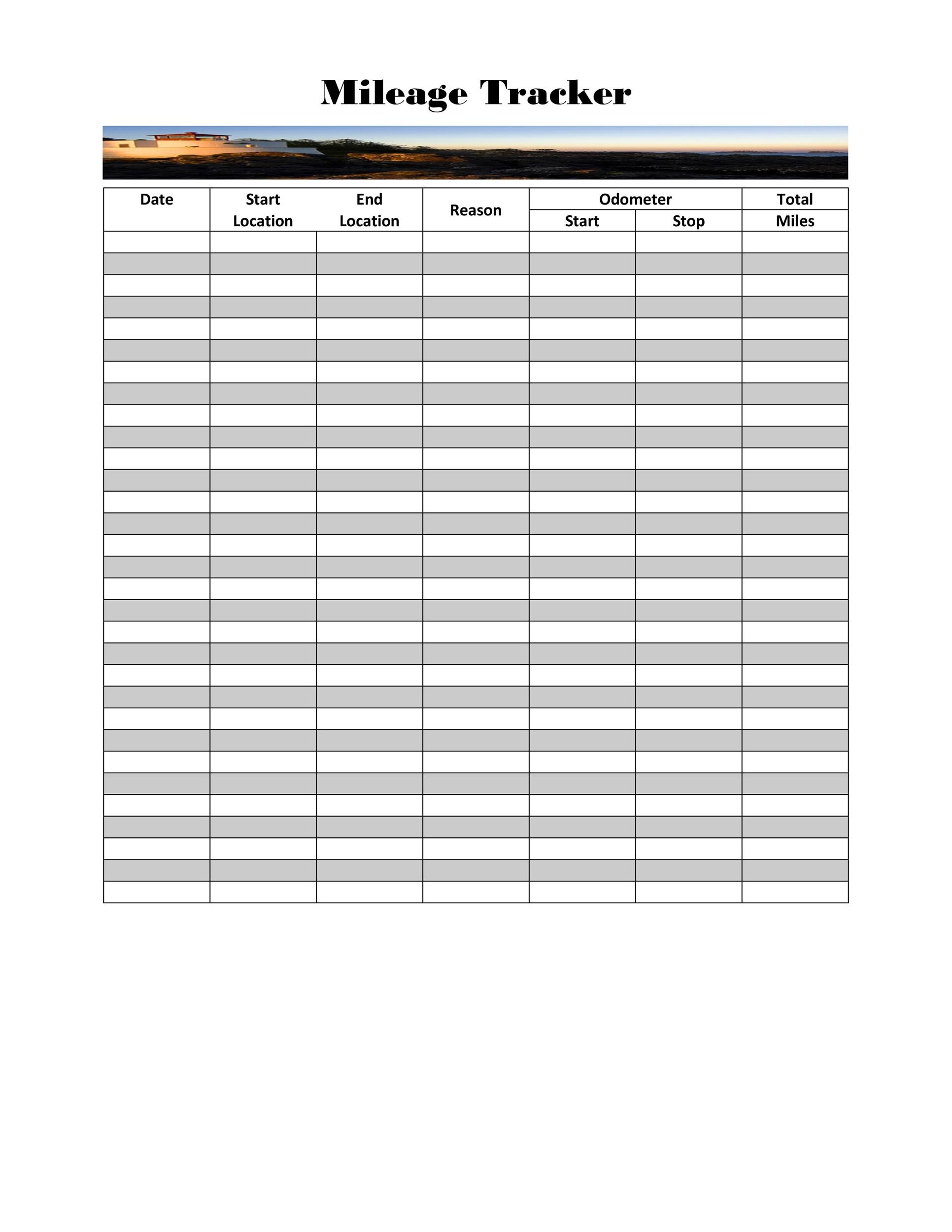

While HMRC has requirements your mileage log must meet to be considered compliant an employer may require that you log additional information compared to the tax authority A mileage logbook typically covers The truth is logging your miles this way isn t required to deduct your car related expenses Tracking your actual car expenses will generally yield you a bigger tax break We ll dive into this below but you can also learn more

More picture related to Do I Need A Mileage Log For Tax Purposes

How To Claim The Standard Mileage Deduction Get It Back

http://www.eitcoutreach.org/wp-content/uploads/which-miles-count.png

50 Sample Mileage Log For Taxes

https://ufreeonline.net/wp-content/uploads/2019/04/sample-mileage-log-for-taxes-best-of-9-mileage-log-templates-doc-pdf-of-sample-mileage-log-for-taxes.jpg

2024 Irs Gas Mileage Audra Anallese

https://templatelab.com/wp-content/uploads/2020/02/IRS-Compliant-Mileage-Log-TemplateLab.com_-790x610.jpg

Its role is to keep travel records for tax purposes Mileage logs are mostly used by businesses and self employed drivers but you may also need one to get a tax deduction for medical Doing this isn t without challenges and a major one is ensuring your employees maintain an acceptable mileage log for IRS purposes The money spent reimbursing

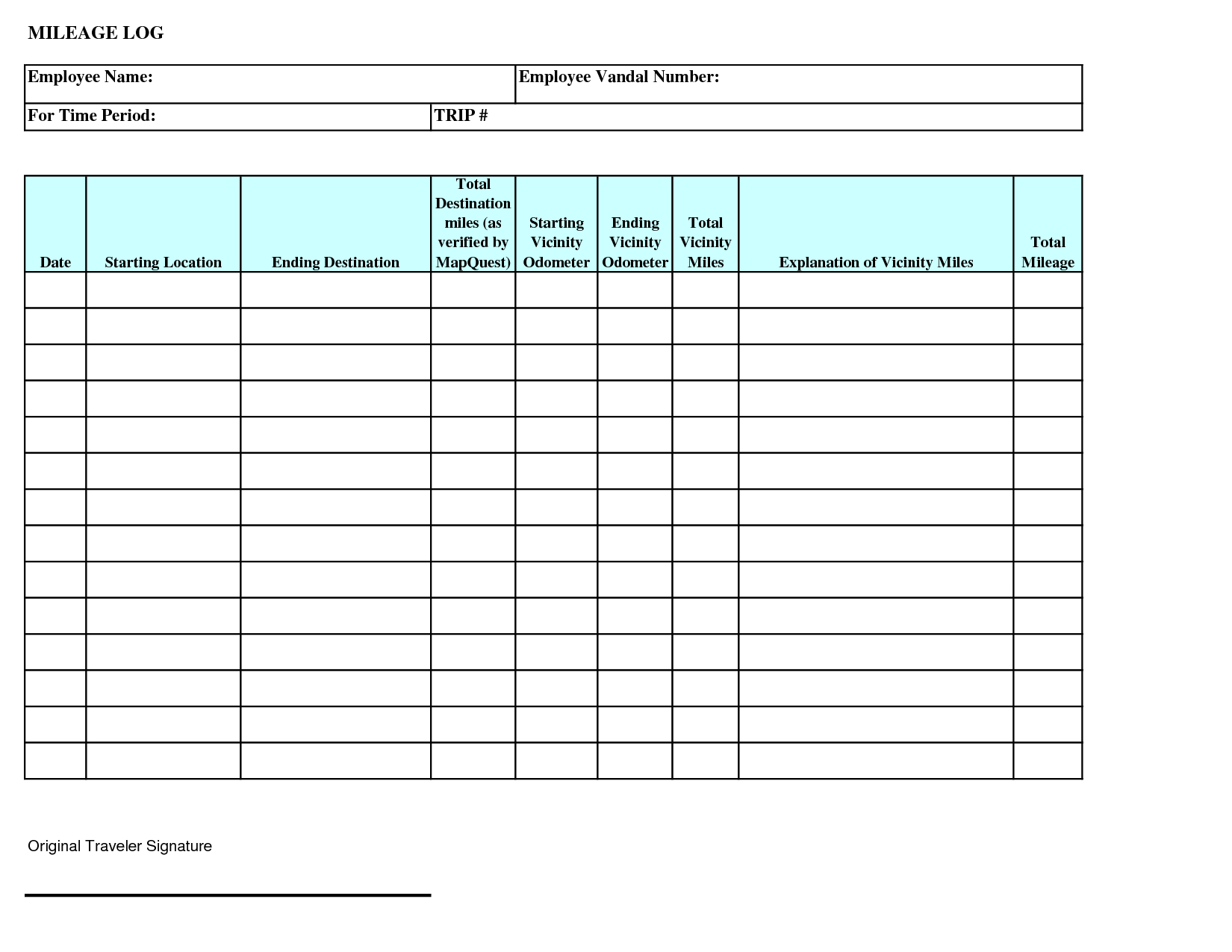

To record mileage for taxes start by keeping a detailed log of your trips noting the date purpose locations and odometer readings You can use manual logging or opt for mileage tracking apps that automatically capture this When it comes to IRS compliant mileage records when you track mileage for taxes accuracy and detail are paramount An IRS compliant log is more than just a record of distances it s a comprehensive document that showcases the purpose and necessity of each trip

Free Mileage Log Spreadsheet Excel Templates

http://www.wordexceltemplates.com/wp-content/uploads/2018/07/Mileage-log-template.jpg

Mileage Reimbursement 2024 Template Word Minni Tabitha

http://templatelab.com/wp-content/uploads/2015/11/Mileage-Log-07.jpg

https://www.mileagewise.com › irs-mileag…

Do I need to keep a Small Business mileage log Keeping a mileage log is essential for various situations Especially if you aim to claim mileage deductions on your

:max_bytes(150000):strip_icc()/IRSSampleBusinessUseofCarLog-c0287e173350497e99732f429aae2305.jpg?w=186)

https://www.mileagewise.com › irs-approved-mileage-log

For Standard Mileage Rate Keep an IRS approved mileage log If you decide to go with the standard mileage rate as most Americans do you ll need to keep a mileage log

Excel Mileage Log Template

Free Mileage Log Spreadsheet Excel Templates

20 Printable Mileage Log Templates Free TemplateLab

Printable Mileage Log 26 Examples Format How To Make Pdf

Printable Mileage Log 26 Examples Format How To Make Pdf

25 Printable IRS Mileage Tracking Templates GOFAR

25 Printable IRS Mileage Tracking Templates GOFAR

7 Vehicle Mileage Log Templates Word Excel PDF Formats

Wages And Taxes Worksheet

Mileage Tracking Sheet Printable

Do I Need A Mileage Log For Tax Purposes - While HMRC has requirements your mileage log must meet to be considered compliant an employer may require that you log additional information compared to the tax authority A mileage logbook typically covers