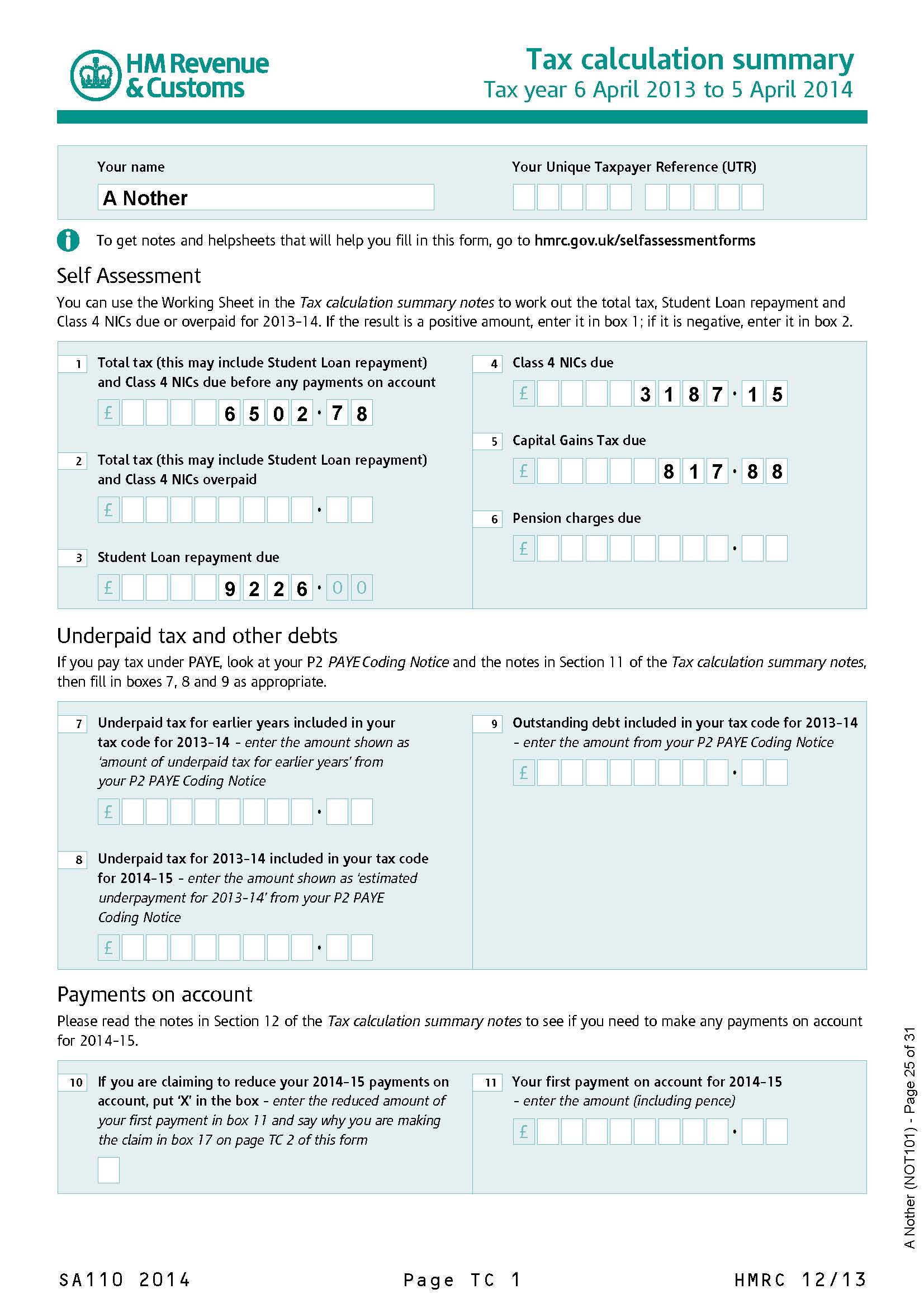

Www Hmrc Gov Uk Mileage Allowance Mileage Allowance Payments MAPs are what you pay your employee for using their own vehicle for business journeys You re allowed to pay your employee a certain amount of MAPs each

Good morning When I was an FY2 doctor in training I was paid travel expenses for my time as an FY2 commuting between my home and my temporary base for the year I have had some acknowledgement for the WFH claims however I have received nothing in relation to my mileage Is it common to not receive anything in relation to the

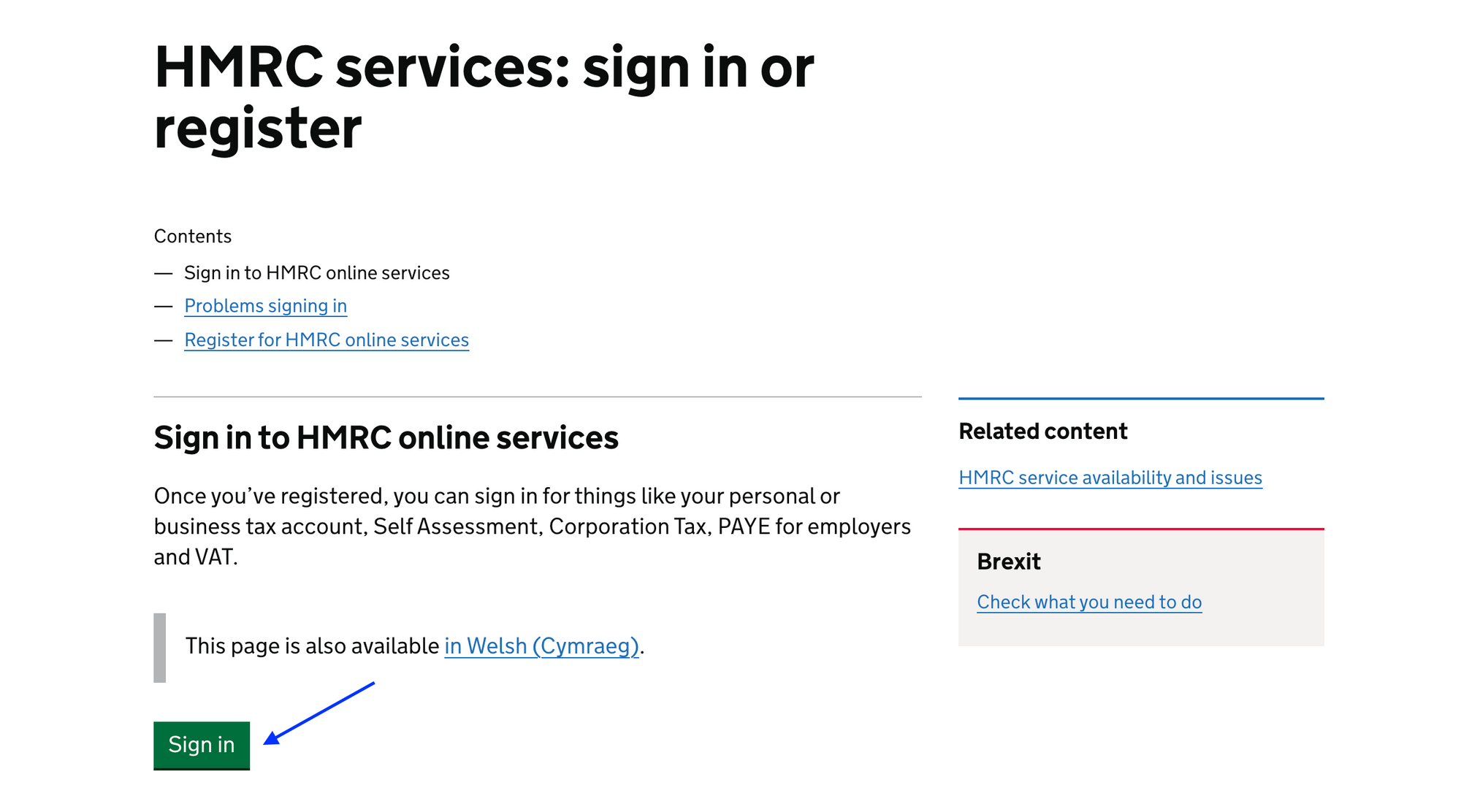

Www Hmrc Gov Uk Mileage Allowance

Www Hmrc Gov Uk Mileage Allowance

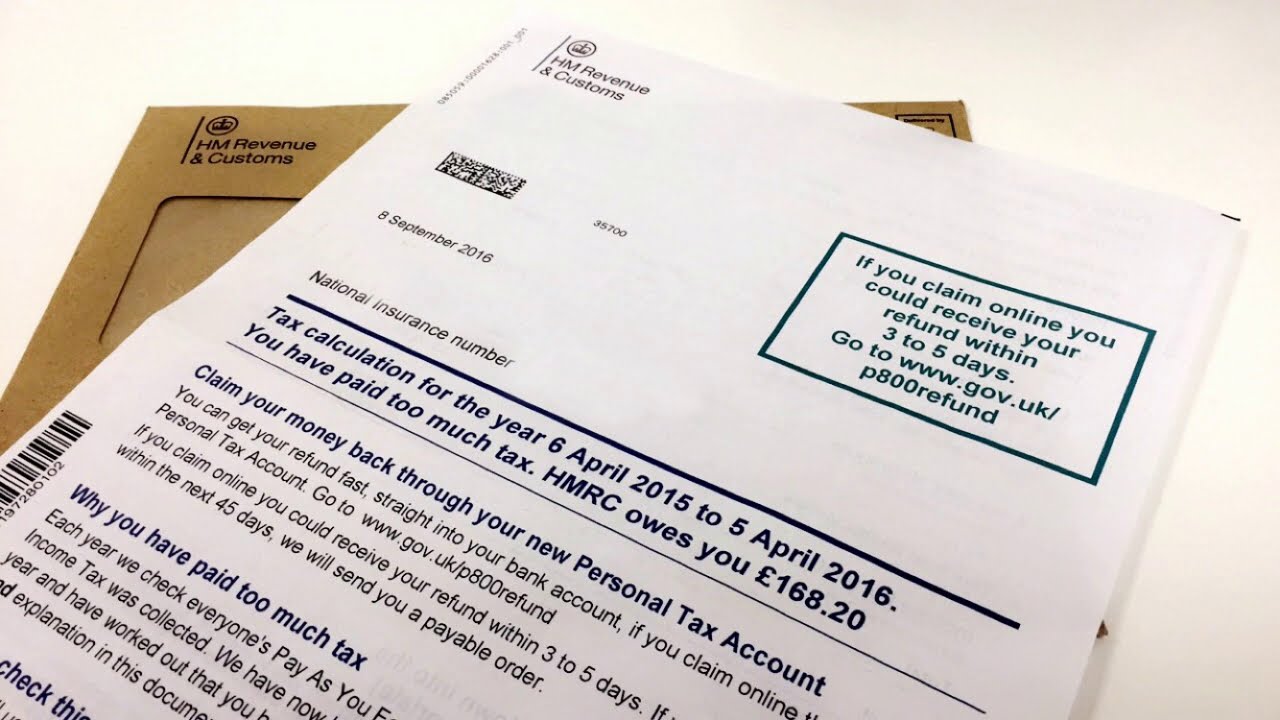

https://i.ytimg.com/vi/fHARONBG43g/maxresdefault.jpg

MauriceEisa

https://www.gatwickaccountant.com/wp-content/uploads/2022/08/How-to-Pay-HMRC-Self-Assessment-Income-Tax-Bill-in-UK.jpg

HMRC AidynShritha

https://www.spondoo.co.uk/wp-content/uploads/2022/06/how-to-recover-your-HMRC-user-ID-and-password.png

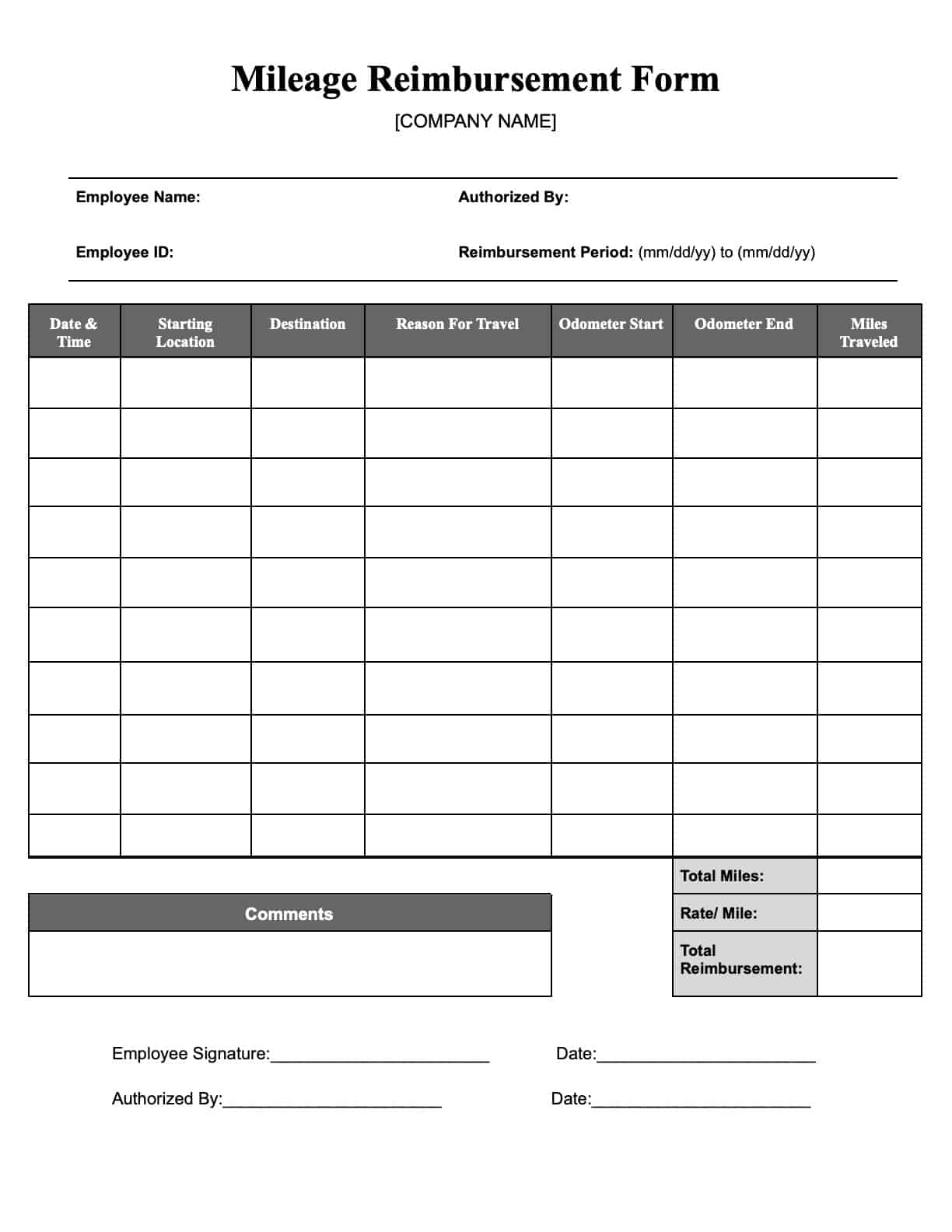

Advisory Fuel rates are for company cars however it is between you and your employer how much they pay for business mileage in your own car If they pay less than the Is mileage allowance in the UK taxable What s the best way to record mileage This article is for employees using their own vehicles for work who are trying to make sense of HMRC s mileage allowance laws and how to

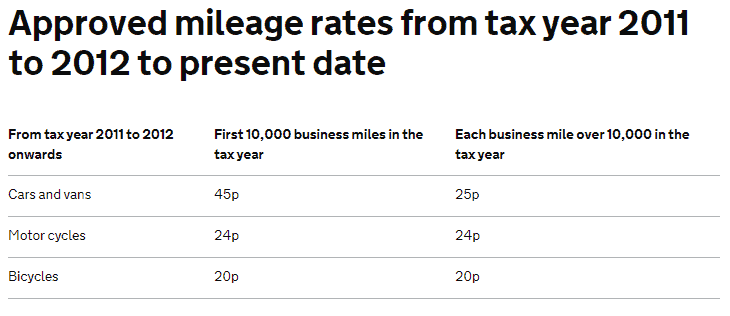

For 2025 HMRC mileage rates are This same rate applies for personally owned electric cars For cars and vans a 10 000 mile threshold applies to mileage covered For the If you use your own vehicle or vehicles for work you may be able to claim tax relief on the approved mileage rate This covers the cost of owning and running your vehicle You cannot

More picture related to Www Hmrc Gov Uk Mileage Allowance

HMRC MarvicBladyn

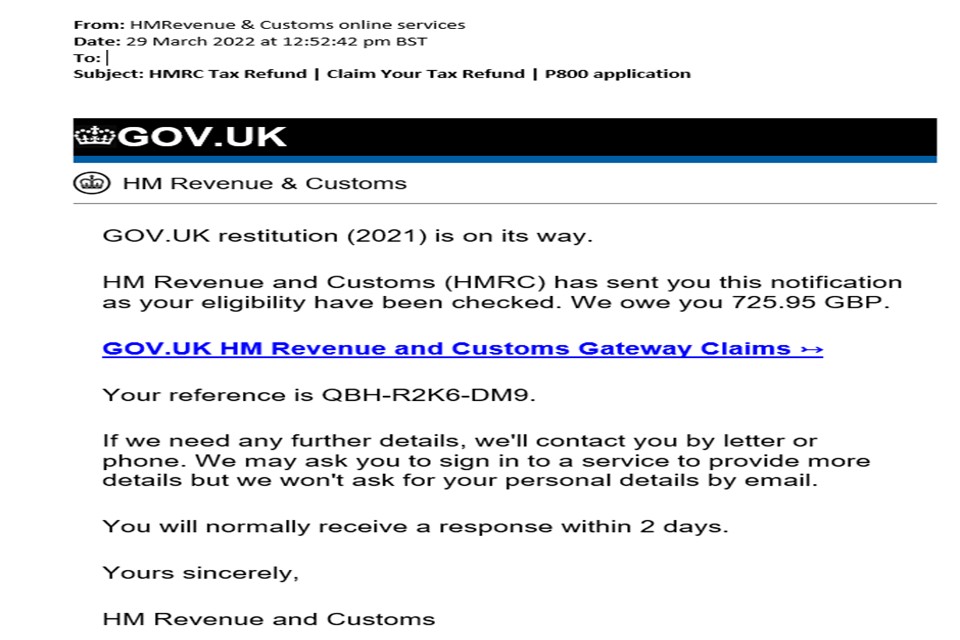

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/149506/Example_of_a_scam_email.jpg

HMRC ZanthiaNyla

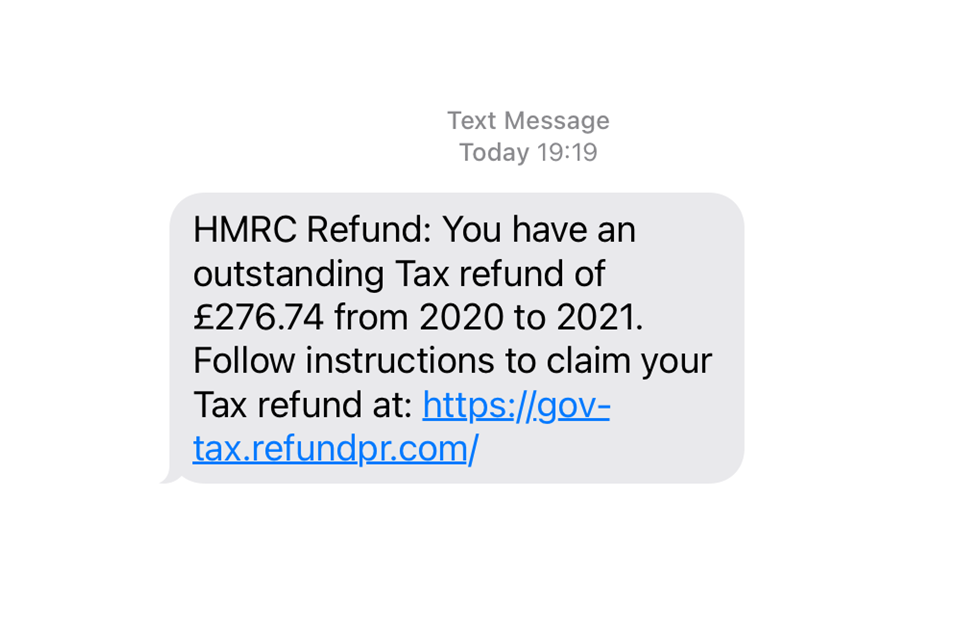

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/132554/HMRC_refund.png

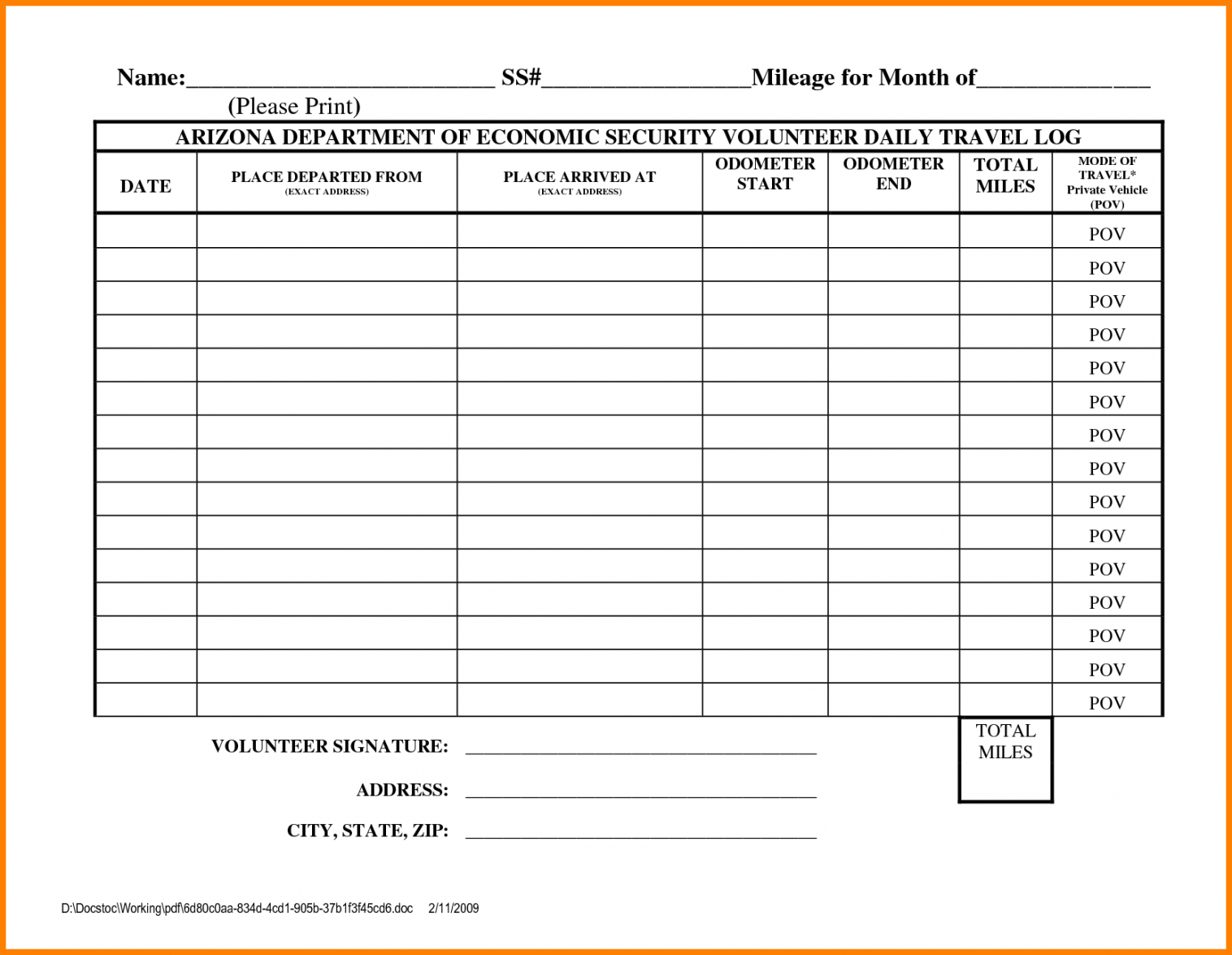

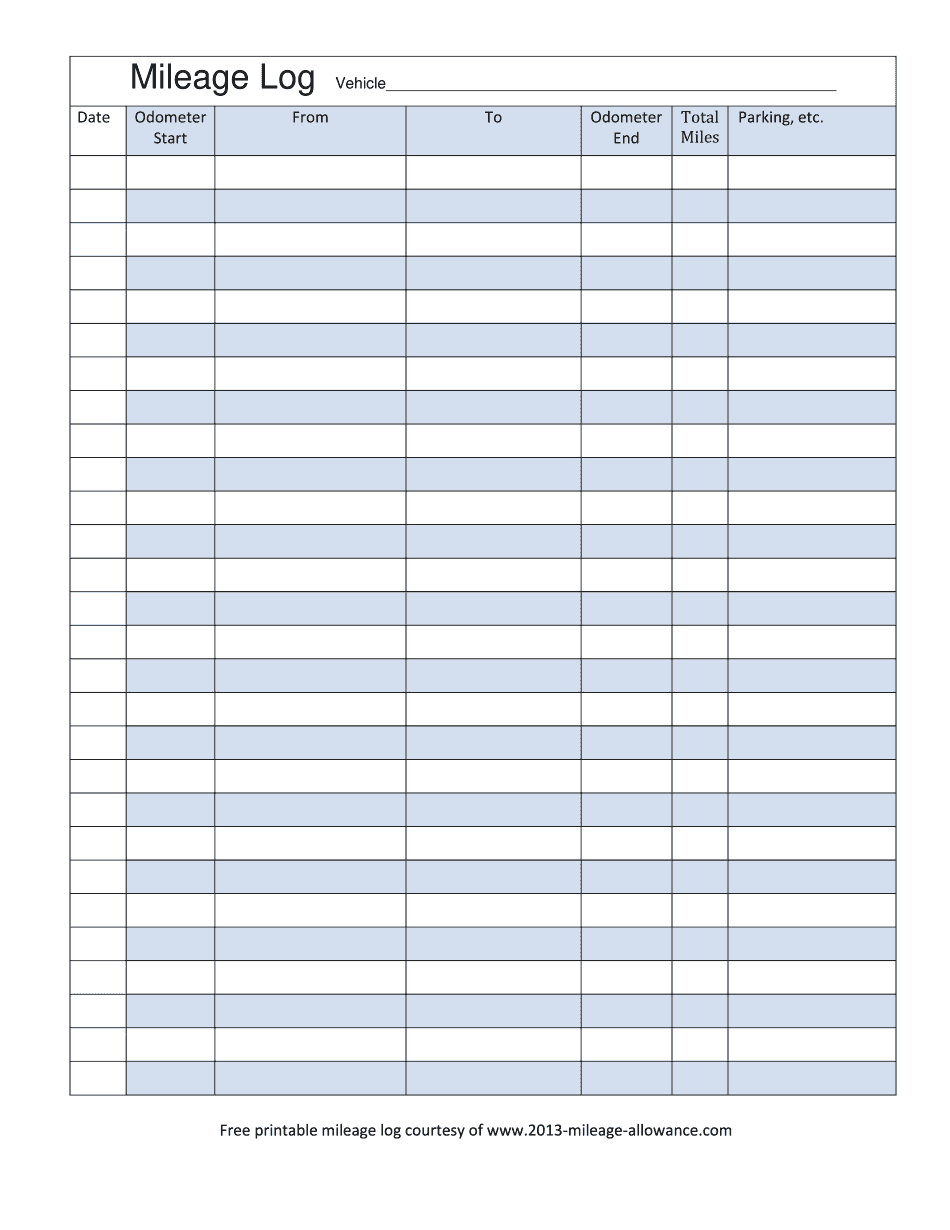

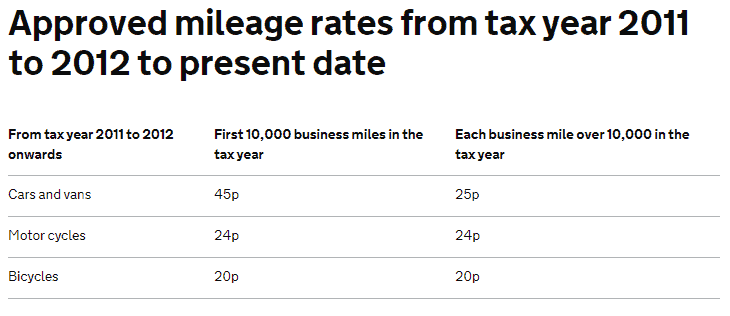

Contoh Template Claim

https://minasinternational.org/wp-content/uploads/2021/03/costum-mileage-claim-form-template-word-sample.png

With it you use a flat rate set by HMRC to calculate your mileage allowance claim The flat rate covers all vehicle costs for your business driving such as fuel maintenance depreciation insurance road tax etc The mileage allowance will be tax free if it does not exceed HMRC s approved mileage allowance payment AMAP rates which are currently as follows Cars and vans first 10 000 business

In this article we ll explore what HMRC mileage allowance payments are when business journeys qualify for tax free mileage allowances the HMRC mileage rates for 2024 and how to keep HMRC sets Approved Mileage Allowance Payment AMAP rates each tax year This means employers can reimburse employees up to a certain amount without declaring the

HMRC Customer Service Phone Number Customer Service

https://phonenumbercustomerservice.co.uk/wp-content/uploads/2017/02/HMRC_logo.jpg

The UK Government Logo Gets A Subtle But Clever Update Creative Bloq

https://cdn.mos.cms.futurecdn.net/UCH3pErMsdSKLo9weVRPkR.jpg

https://www.gov.uk › expenses-and-benefits-business...

Mileage Allowance Payments MAPs are what you pay your employee for using their own vehicle for business journeys You re allowed to pay your employee a certain amount of MAPs each

https://community.hmrc.gov.uk › customerforums › pt

Good morning When I was an FY2 doctor in training I was paid travel expenses for my time as an FY2 commuting between my home and my temporary base for the year

Gov Mileage 2024 Rena Valina

HMRC Customer Service Phone Number Customer Service

Mileage Rate In 2025 James Idris

Self Employed Mileage Allowance How To Claim It

Product Detail

What Is The 2024 HMRC Mileage Rate UK Mileage Guide

What Is The 2024 HMRC Mileage Rate UK Mileage Guide

Hmrc Mileage Allowance Management And Leadership

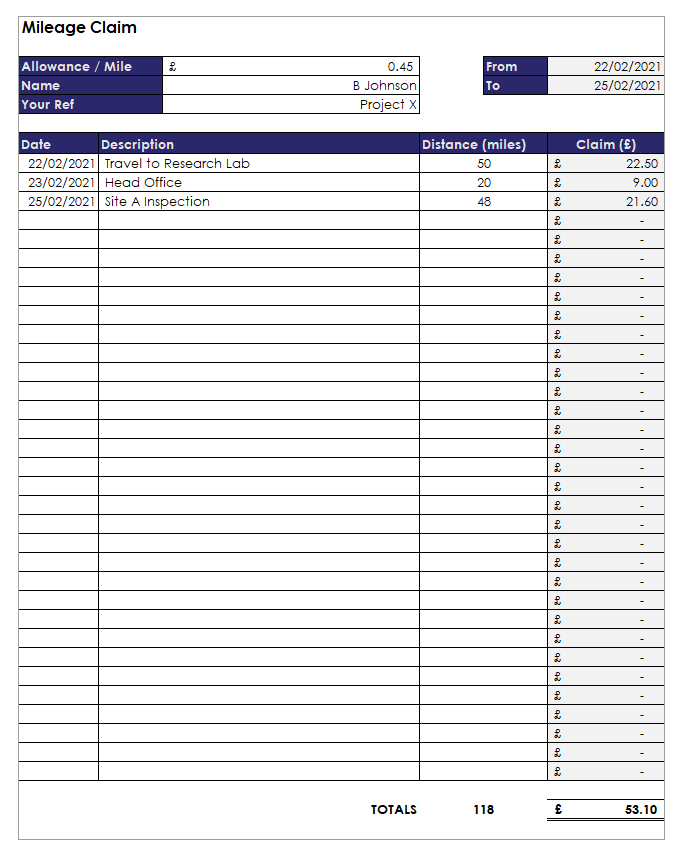

How To Create A Government Gateway Account On HMRC s Online Portal

Contractor Mortgages Online Self Self Assessment Freelancer Advice

Www Hmrc Gov Uk Mileage Allowance - My employer provides expenses for the mileage but the amount paid is less than the 45p rate I have to complete a self assesement each year Whereabouts i e what section