Mileage Log Template Excel Download Free Download However when I lodge my last year s tax return I found that both the taxable and non taxable mileage reimbursements are included in my taxable income In this case I would

When reimbursing an employee for work related travel while using their private vehicle can I split the Award travel reimbursement rate of 0 95c into 0 85c non taxable and ATO CommunityLoading Sorry to interrupt CSS Error Refresh

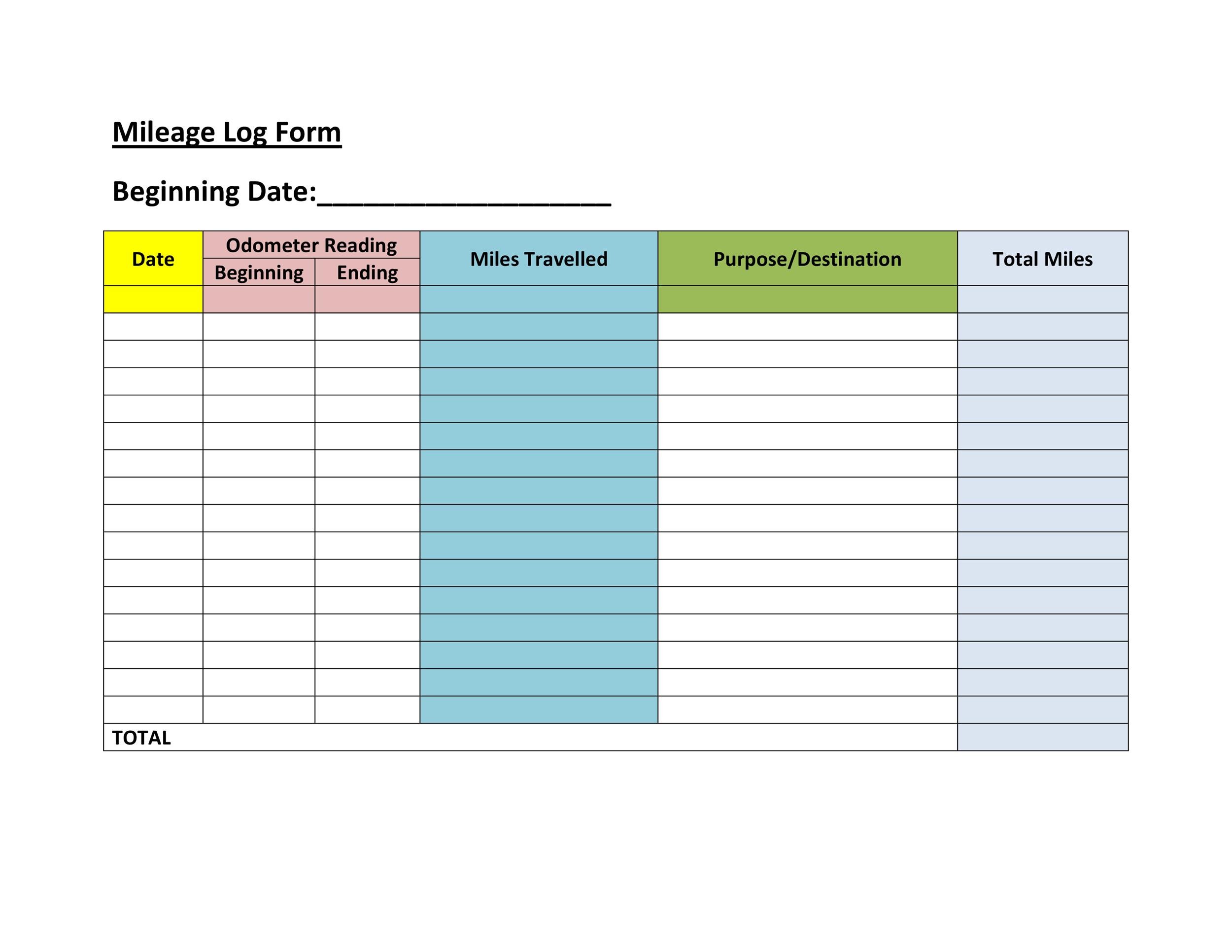

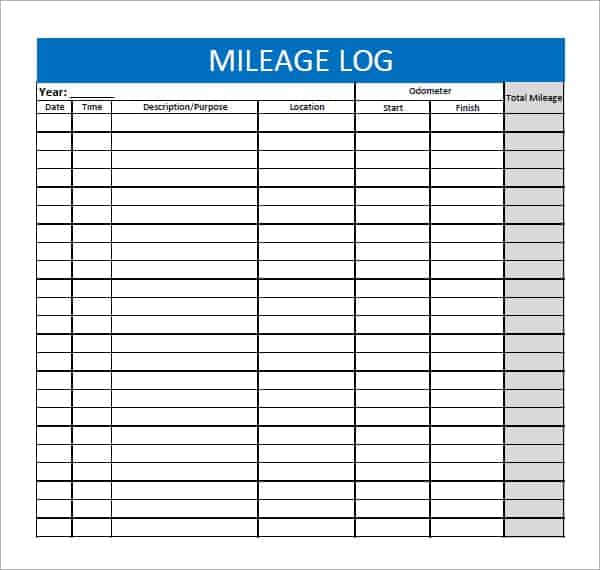

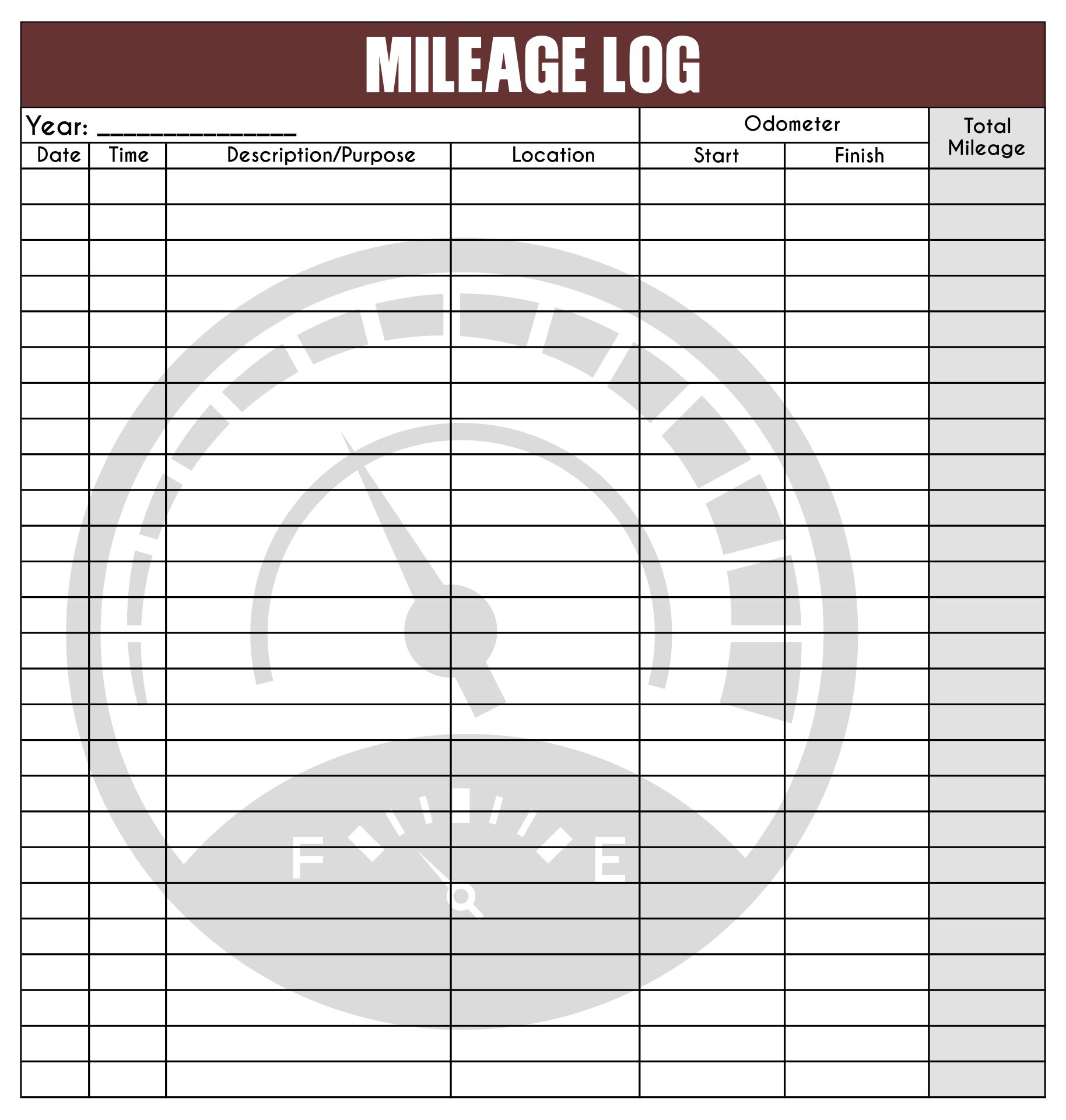

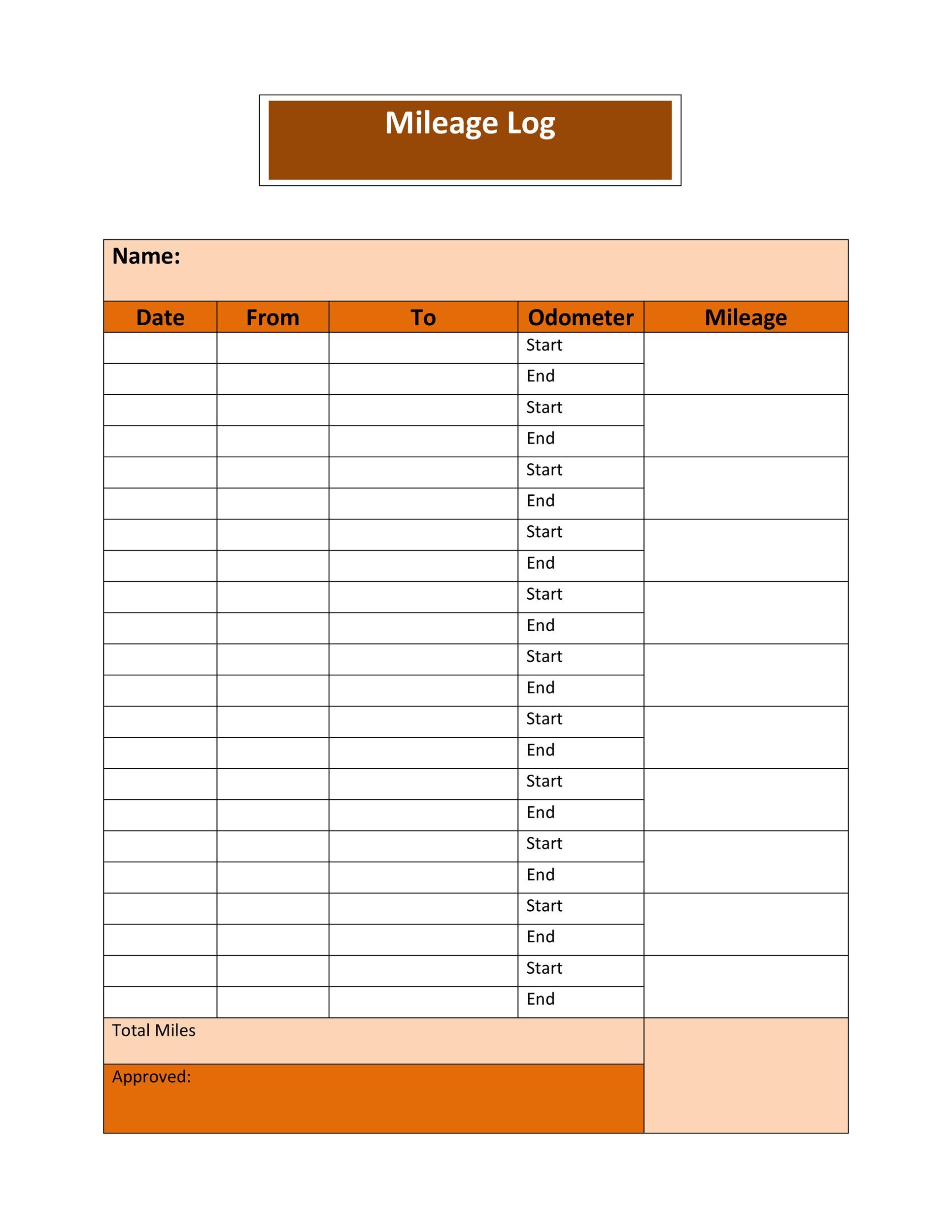

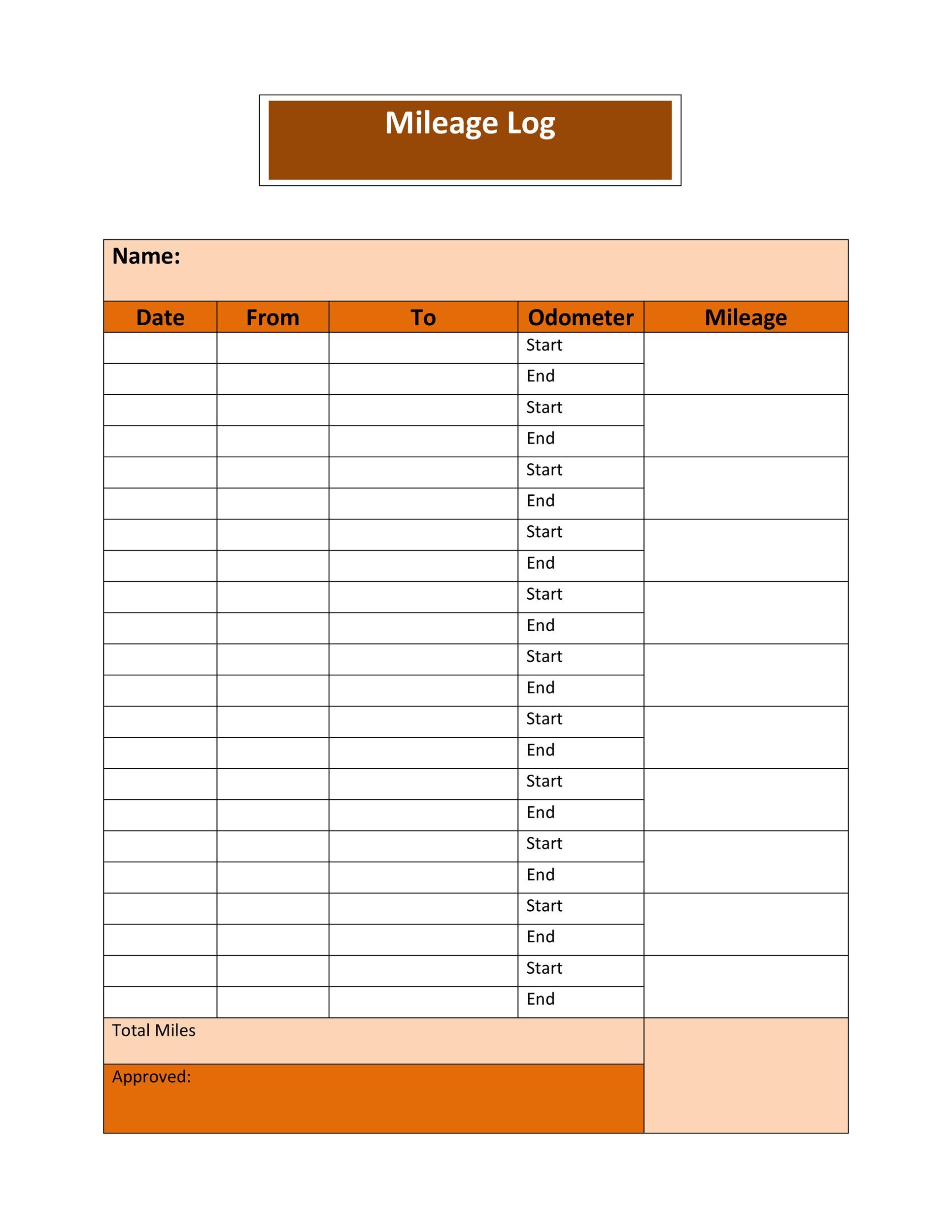

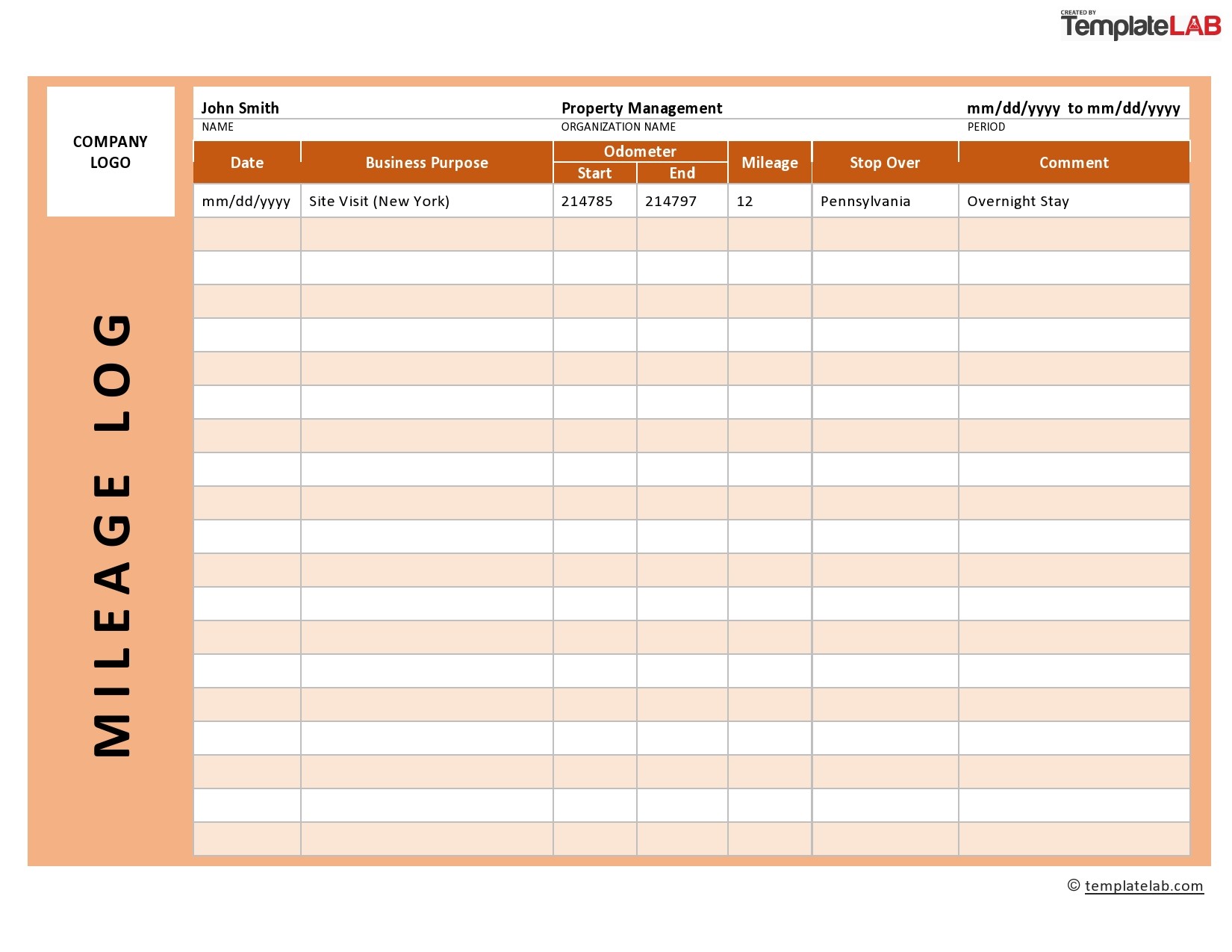

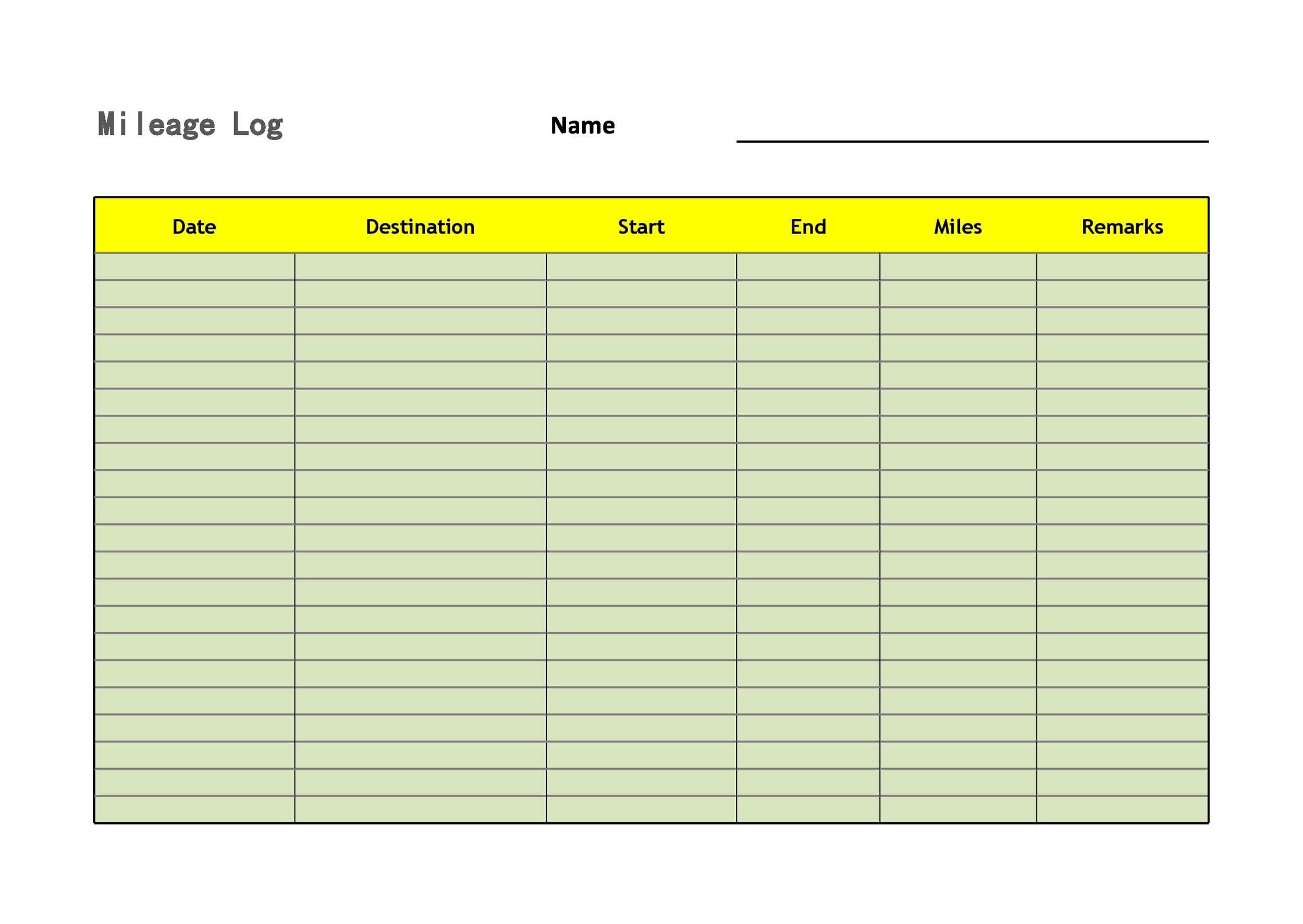

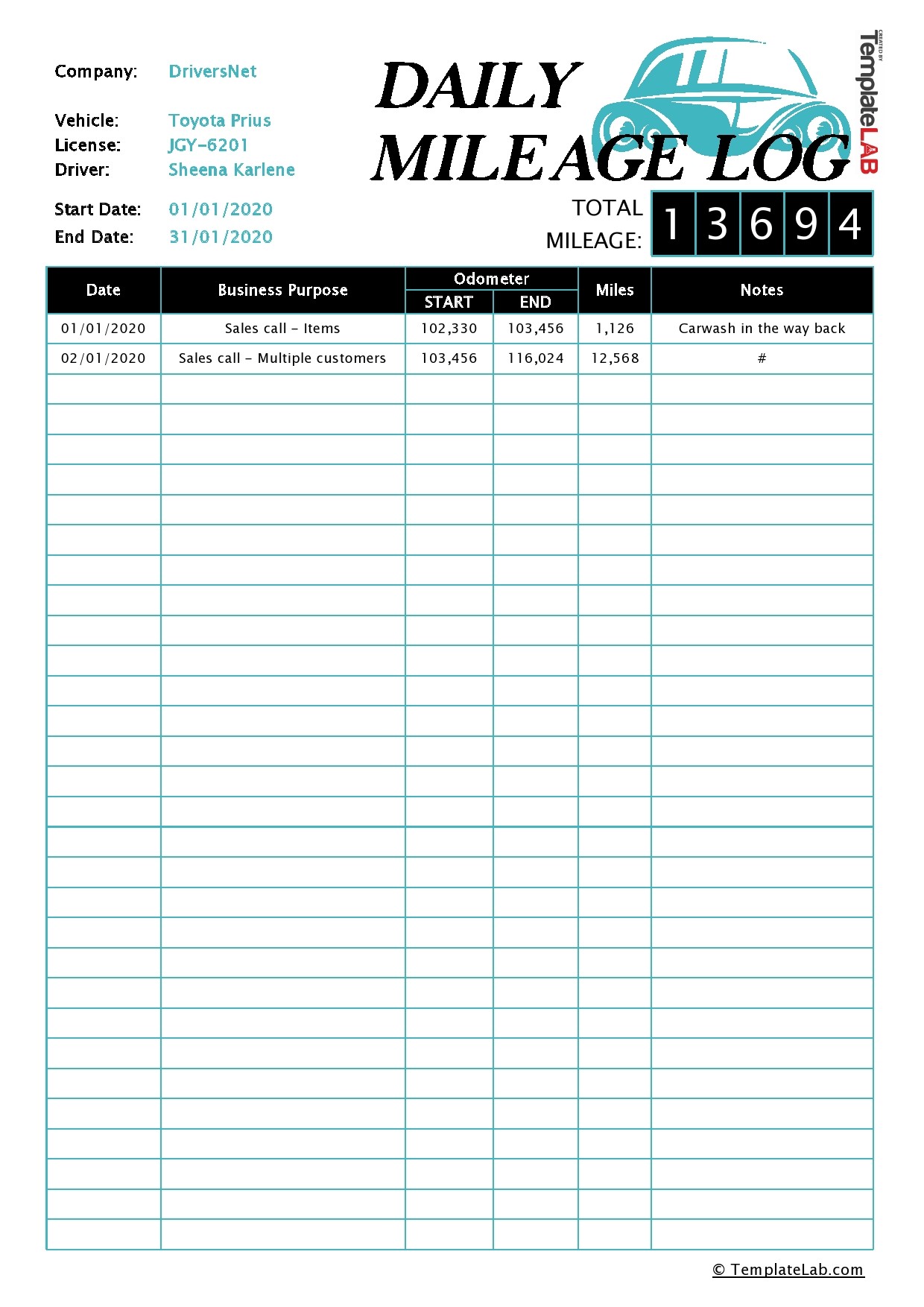

Mileage Log Template Excel Download Free Download

Mileage Log Template Excel Download Free Download

http://templatelab.com/wp-content/uploads/2015/11/Mileage-Log-10.jpg

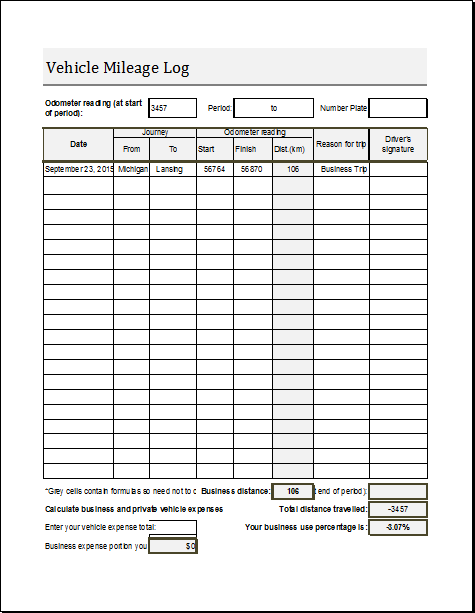

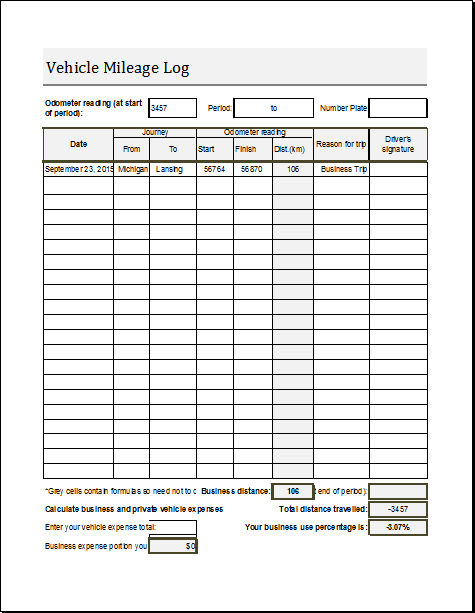

Vehicle Mileage Log Template For MS EXCEL Document Hub

http://www.doxhub.org/wp-content/uploads/2016/03/vehicle-mileage-log.png

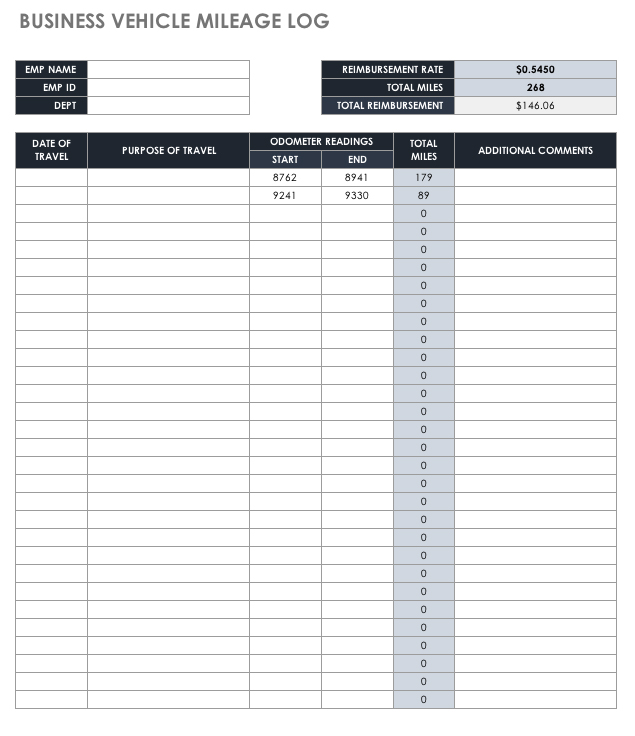

30 Free Mileage Log Templates Excel Log Sheet Format Project

https://3.bp.blogspot.com/-SRjCmc0iN_A/XLoClUl-0FI/AAAAAAAABbU/500APwO252IcnBwDQoamLoaANtcJfGLVACLcBGAs/s1600/Business%2BVehicle%2BMileage%2BLog%2BTemplate.jpg

Hello there We re paying employees a mileage rate to use their own vehicles for work purposes The mileage rate is listed under their Award I m finding conflicing information Due to the high mileage that I cover the depreciation of my vehicle is usually greater than similar vehicles on the market and therefore there is always a large gap between

Hi I have just started a partnership and need to complete a partnership tax return my question is if you have individual expenses ie mileage for using vehicle for business Hi yuwiee If you re being paid under the cents per km method it s considered an allowance because they re not covering the exact expense you incur a reimbursement For

More picture related to Mileage Log Template Excel Download Free Download

Vehicle Mileage Log Editable Excel Worksheet Employee Policy Travel

https://i.etsystatic.com/33485018/r/il/172830/5407197079/il_fullxfull.5407197079_n50t.jpg

Mileage Log Book Template

http://www.sampletemplatess.com/wp-content/uploads/2017/11/Mileage-Log-Book-Template-Free.jpg

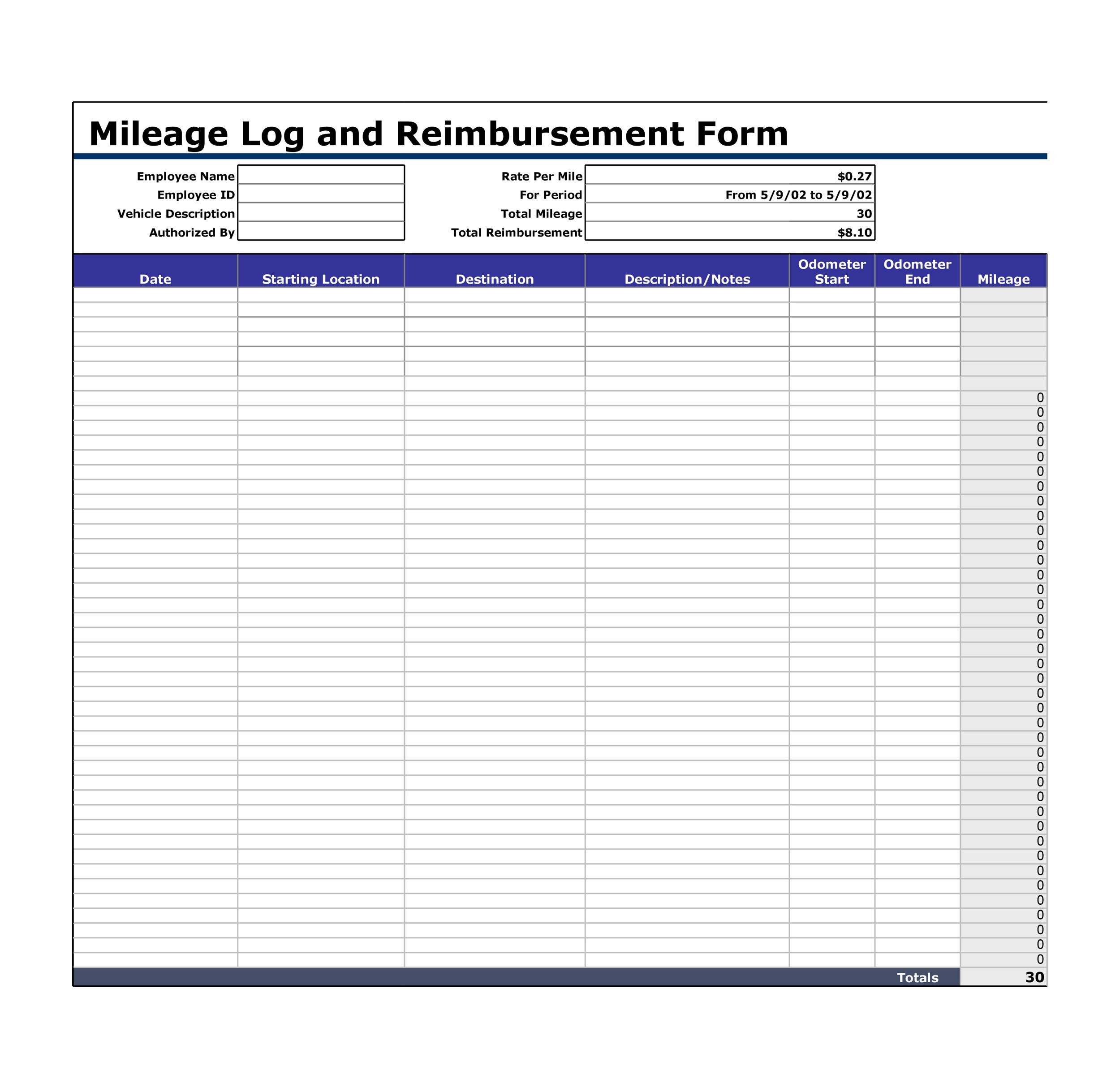

Printable Mileage Form Printable Forms Free Online

http://templatelab.com/wp-content/uploads/2015/11/Mileage-Log-22.jpg

update odometer 23 mileage 23 read odometer It s important to note that while reimbursements may be taxable you may also be eligible for tax deductions related to work related expenses such as mileage expenses for

[desc-10] [desc-11]

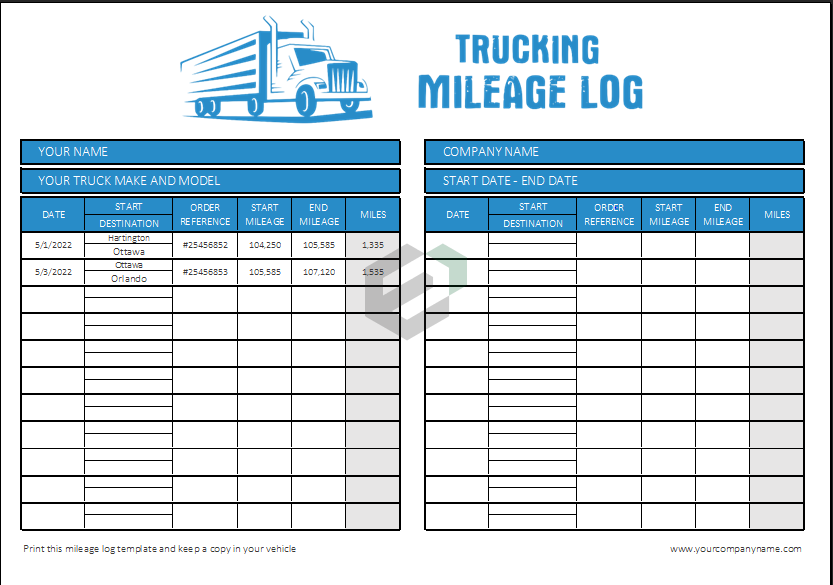

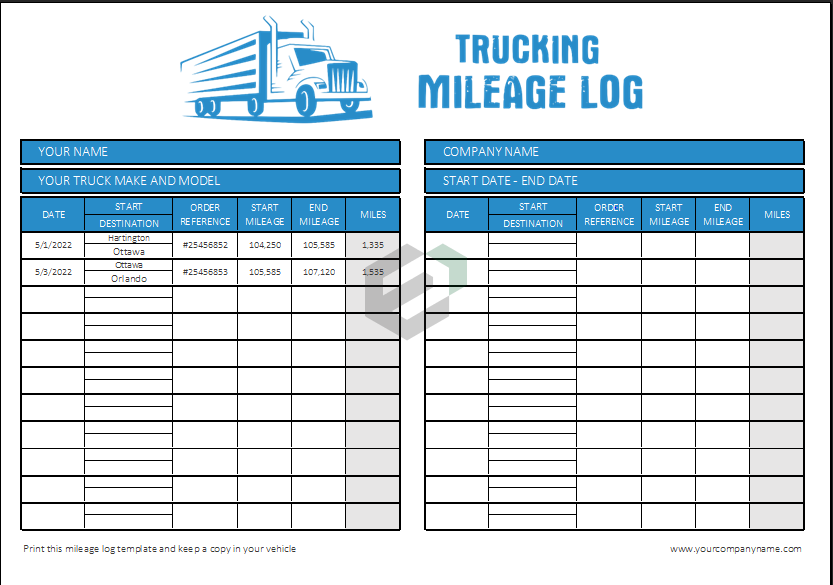

Printable Free Trucking Mileage Log Excel Template

https://exceldownloads.com/wp-content/uploads/2022/09/Trucking-Mileage-Log-Excel-Template-Feature-Image.png

31 Printable Mileage Log Templates Free TemplateLab

http://templatelab.com/wp-content/uploads/2015/11/Mileage-Log-16.jpg

https://community.ato.gov.au › question

However when I lodge my last year s tax return I found that both the taxable and non taxable mileage reimbursements are included in my taxable income In this case I would

https://community.ato.gov.au › question

When reimbursing an employee for work related travel while using their private vehicle can I split the Award travel reimbursement rate of 0 95c into 0 85c non taxable and

Download Excel Mileage Spreadsheet Template Microsoft Free Brooklyntrust

Printable Free Trucking Mileage Log Excel Template

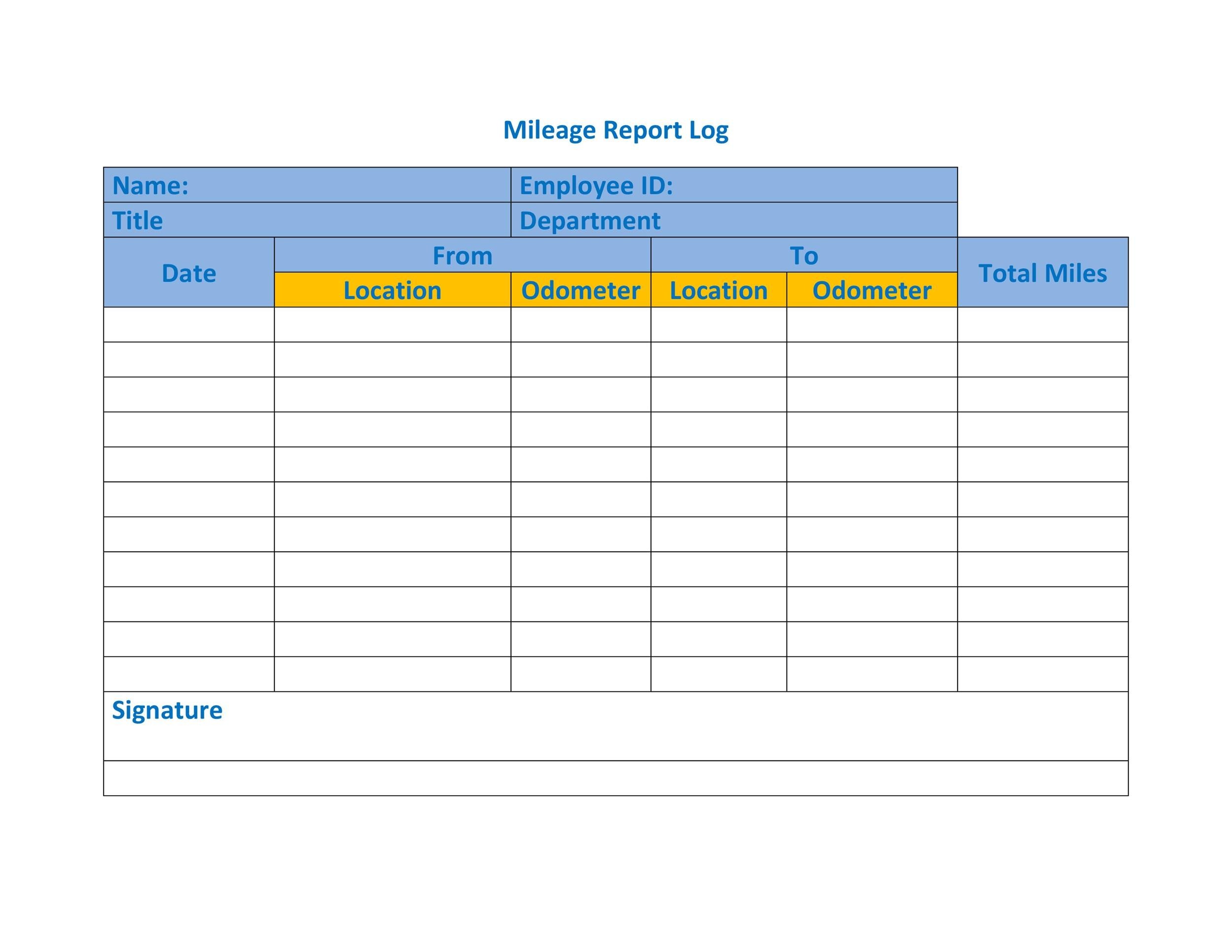

7 Vehicle Mileage Log Templates Word Excel PDF Formats

Free Printable Mileage Log Templates PDF Excel

Timesheet With Mileage Template

31 Printable Mileage Log Templates Free TemplateLab

31 Printable Mileage Log Templates Free TemplateLab

20 Printable Mileage Log Templates Free TemplateLab

31 Printable Mileage Log Templates Free TemplateLab

20 Printable Mileage Log Templates Free TemplateLab

Mileage Log Template Excel Download Free Download - [desc-12]