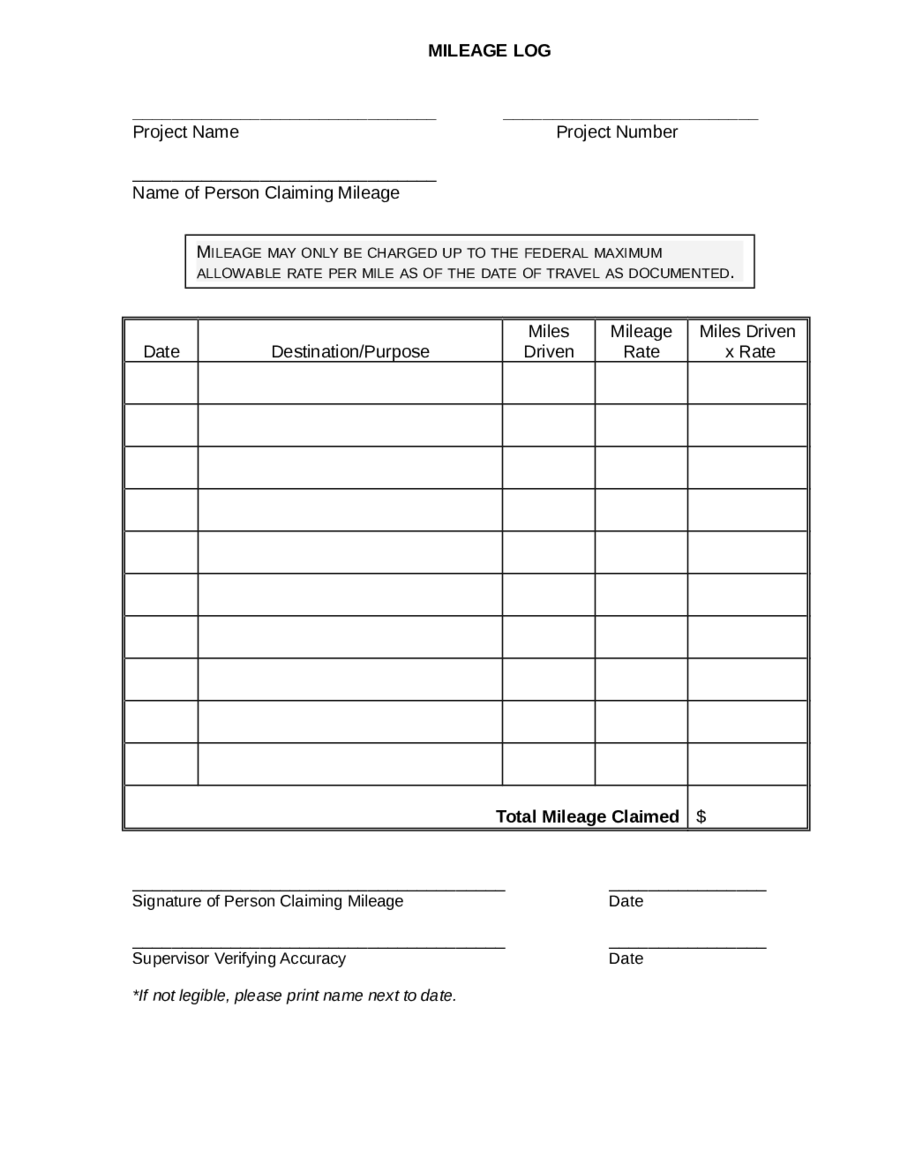

Mileage Forms For Tax Purposes Hi just wondering whether someone could clarify as to whether GST applies to the reimbursements calculated using the cents per kilometer mileage method based on the actual

We reimburse employee kilometer claims at current ATO rates We are not under awards The reimbursement is based on actual mileage use of personal vehicles for business No TryingHard you still pay the employee the c km allowance as per the industrial instrument However tax concessions are ONLY provided when ALL of the

Mileage Forms For Tax Purposes

Mileage Forms For Tax Purposes

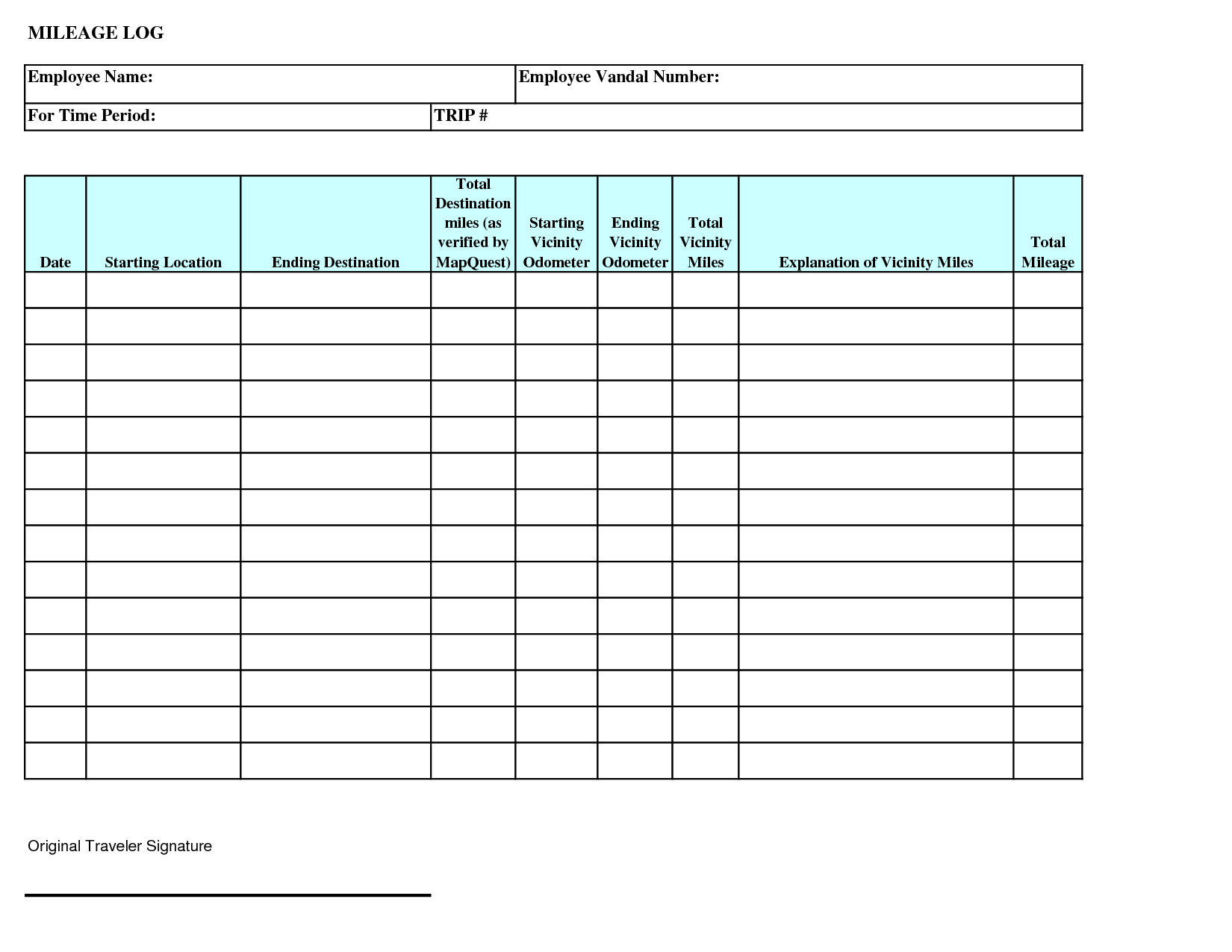

https://eforms.com/images/2020/01/IRS-Mileage-Reimbursement-Form.png

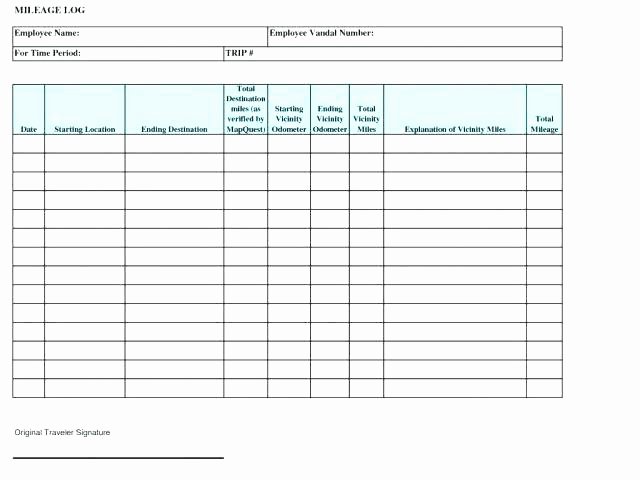

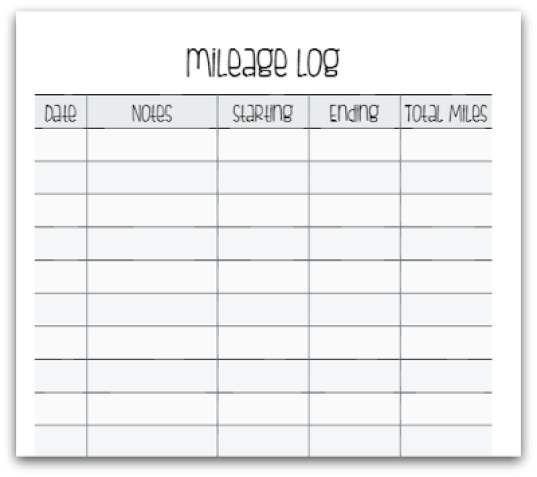

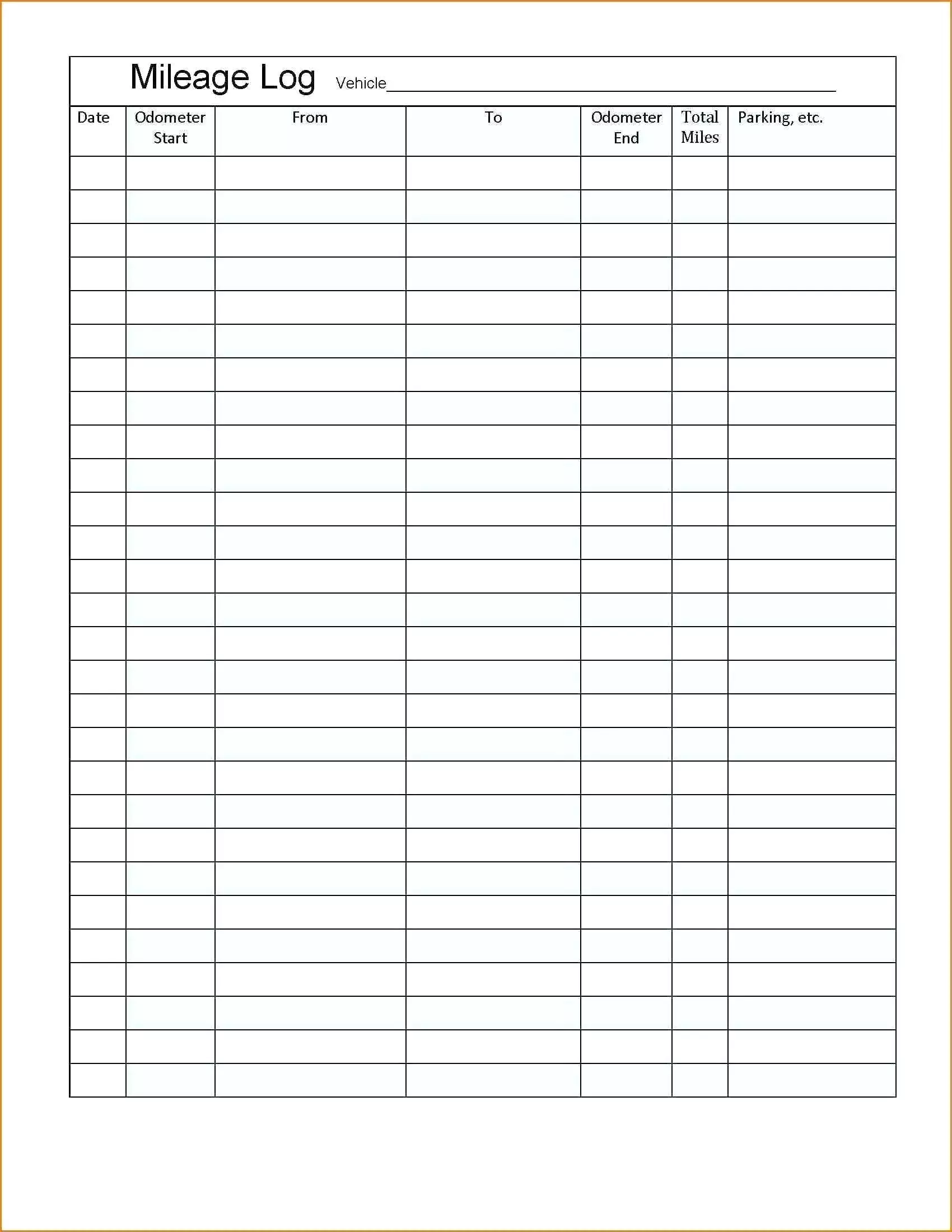

Mileage Log Template For Taxes Best Of Mileage Form Forms Reimbursement

https://i.pinimg.com/736x/05/44/db/0544db65c8f3d287afca705dfb0bc245.jpg

Pin On Book Template Childcare

https://i.pinimg.com/736x/ca/89/f9/ca89f9771e915fa050817ed6a21e18c2.jpg

As an employer can i reimburse the employees for the car expenses incurred for work travel based on ATO s cents per mileage If this is treated as expense reimbursement Loading Sorry to interrupt CSS Error

TobyJDodd Thanks Tony That s great that clears all that query up On a slightly sideways note i m just slightly over on the 5000km claimable allowed in the per km method for When reimbursing an employee for work related travel while using their private vehicle can I split the Award travel reimbursement rate of 0 95c into 0 85c non taxable and

More picture related to Mileage Forms For Tax Purposes

Irs 2025 Mileage Guidelines Riley Aziza

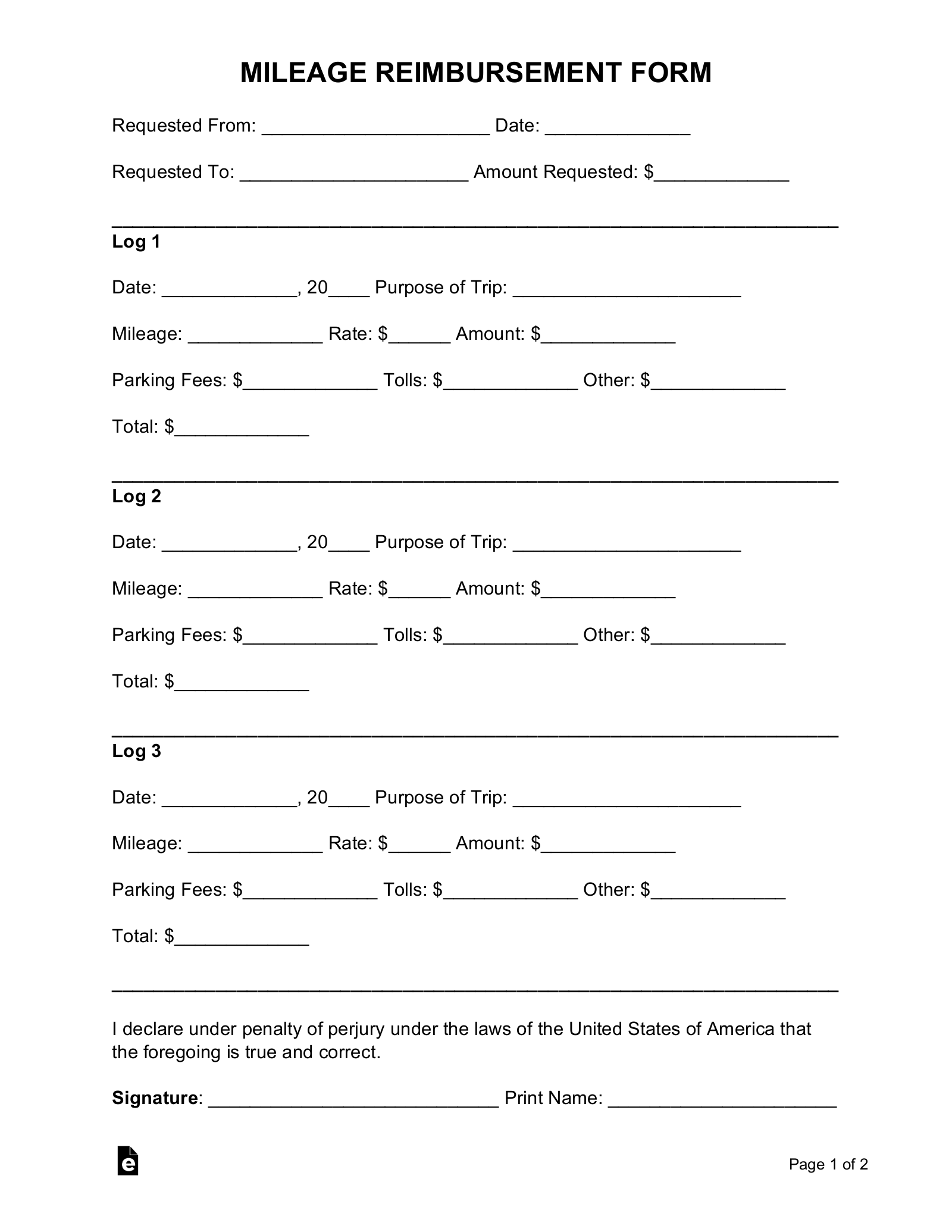

https://templatelab.com/wp-content/uploads/2020/02/IRS-Compliant-Mileage-Log-TemplateLab.com_.jpg

Mileage Log Template For Taxes Shooters Journal

https://shootersjournal.net/wp-content/uploads/2019/04/mileage-log-template-for-taxes-new-mileage-forms-for-tax-purposes-echotrailers-of-mileage-log-template-for-taxes.jpg

Vehicle Log Sheet Excel Templates

https://www.pdffiller.com/preview/100/110/100110492/large.png

Our company reimburse employee work related mileage at ATO rate base on actual distance of business travel incurred Are these reimbursements considered taxable Howdy kevanM Possibly it depends Are you a sole trader running your own business You can claim business km s you do when performing your work

[desc-10] [desc-11]

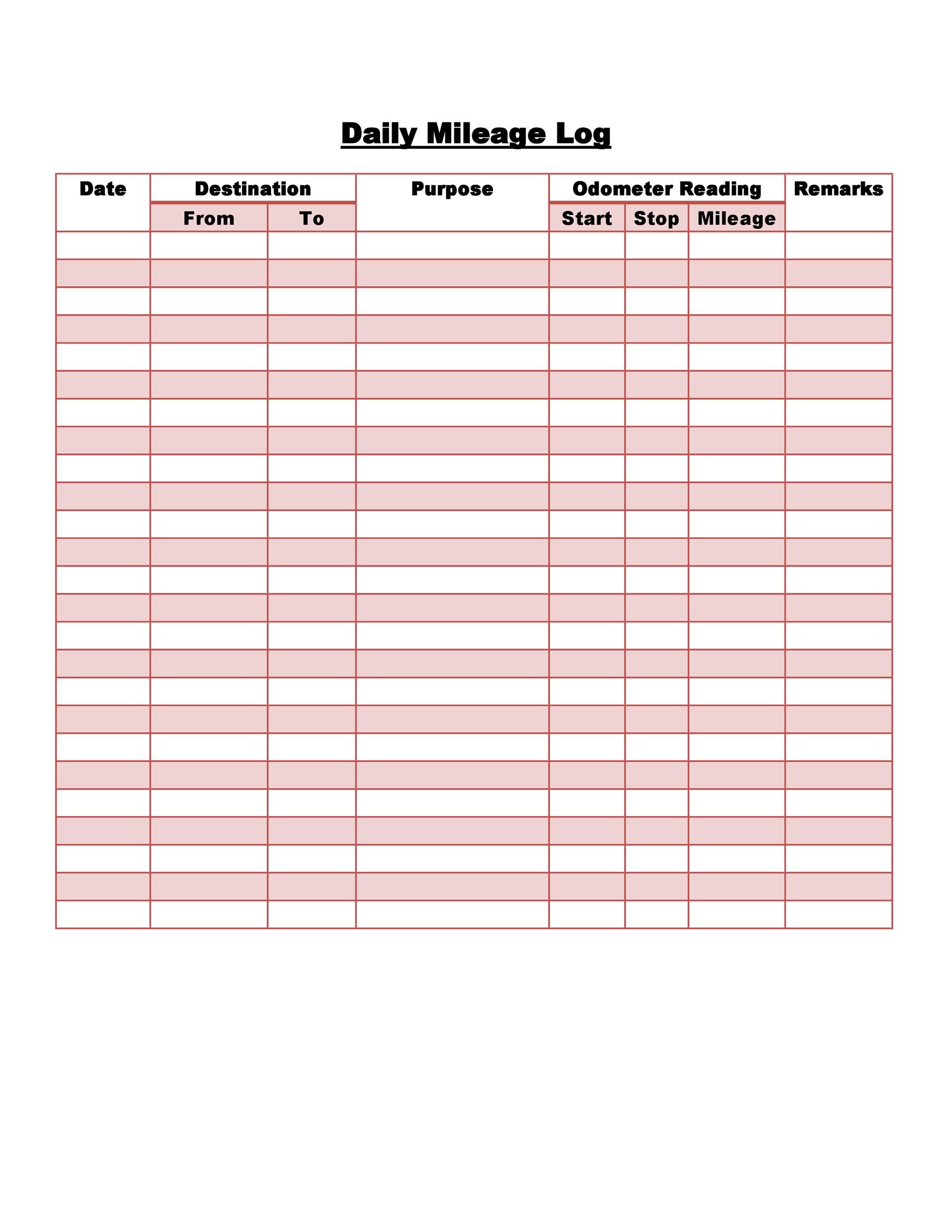

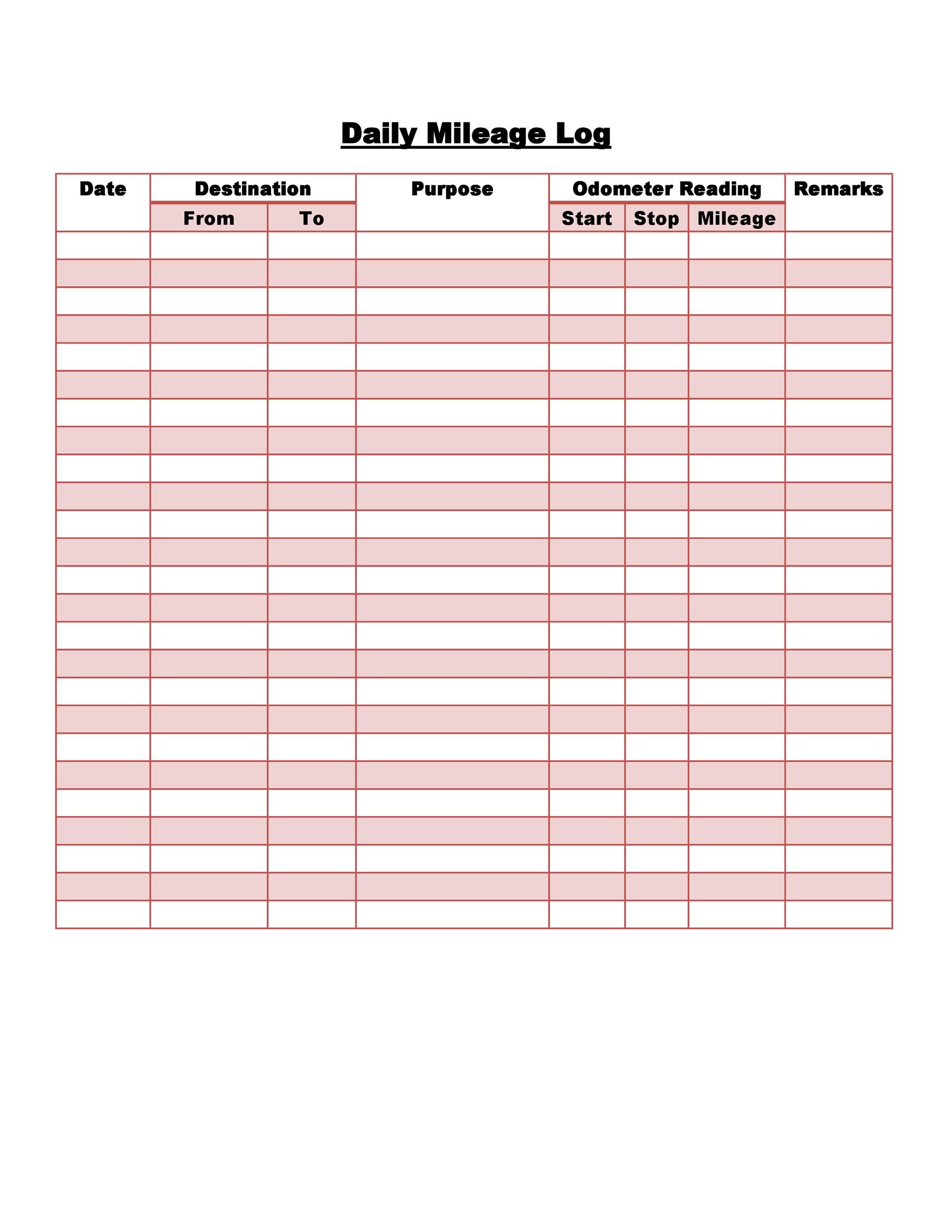

Mileage Reimbursement Log Excel Templates

https://i.pinimg.com/originals/53/f2/a9/53f2a96e5eb5f5800f628dee4d35e92e.jpg

Mileage Tracker Template Excel Templates

https://images.examples.com/wp-content/uploads/2018/06/Simple-Printable-Mileage-Log.png

https://community.ato.gov.au › question

Hi just wondering whether someone could clarify as to whether GST applies to the reimbursements calculated using the cents per kilometer mileage method based on the actual

https://community.ato.gov.au › question

We reimburse employee kilometer claims at current ATO rates We are not under awards The reimbursement is based on actual mileage use of personal vehicles for business

Mileage Rate In 2025 James Idris

Mileage Reimbursement Log Excel Templates

Self Employed Mileage Log Template

Free Mileage Log Spreadsheet Excel Templates

Free Mileage Log Spreadsheet Excel Templates

Mileage Forms 2024 Esther Karalee

Mileage Forms 2024 Esther Karalee

Printable Mileage Form Printable Forms Free Online

2023 Mileage Form Printable Forms Free Online

Mileage Tracker Form Printable Printable Forms Free Online

Mileage Forms For Tax Purposes - [desc-12]