Is Giving Employees Gift Cards Taxable An employer can explore several avenues to potentially provide tax free gifts to employees but each comes with its own requirements to qualify for preferential tax treatment

Gift cards given to employees are generally considered taxable income and must be reported on their W 2 forms The IRS treats gift cards as cash equivalents meaning they Yes gift cards are taxable In the eyes of the IRS giving your employees a gift card with a cash value is like giving them a bonus The same goes for gift certificates for cash

Is Giving Employees Gift Cards Taxable

Is Giving Employees Gift Cards Taxable

https://i.ytimg.com/vi/CaOriXKpHrY/maxresdefault.jpg

Are Gift Cards Taxable In Germany YouTube

https://i.ytimg.com/vi/yA6D2X5f4Gc/maxresdefault.jpg

Gift Income Tax On Gift Exempt Gift Taxable Gift Planning With

https://i.ytimg.com/vi/lD94gyWLqkU/maxresdefault.jpg

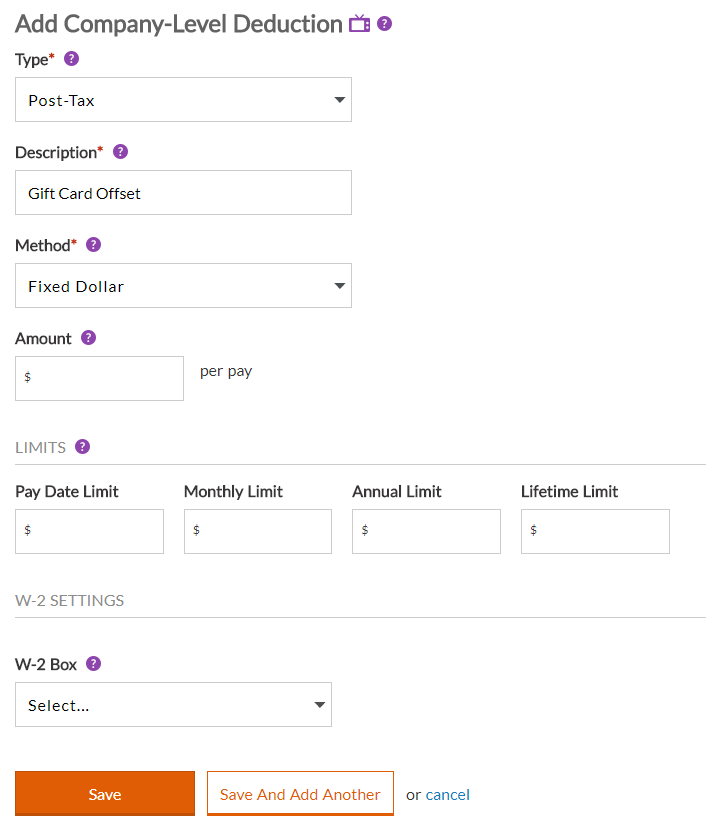

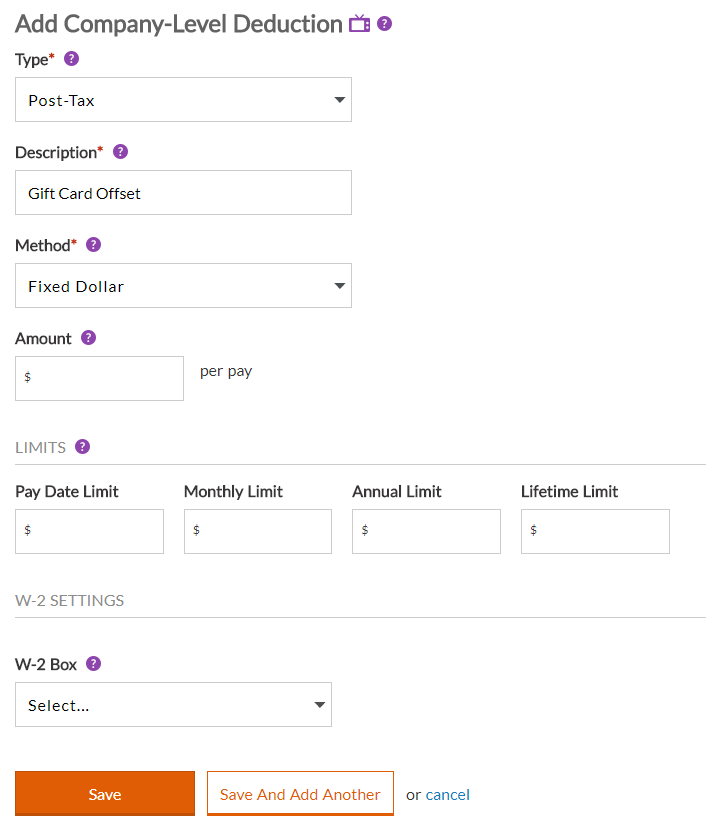

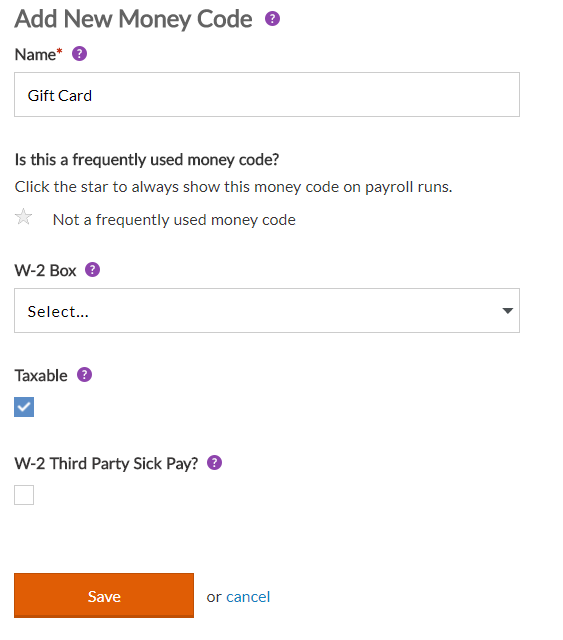

Employee gifts may or not be taxable depending on the type of gift and its value Gifts of cash or cash equivalents such as gift cards are taxable to the employee regardless of the Do employees have to pay taxes on gift cards If you give your employees a gift card the IRS considers it a cash equivalent fringe benefit This means you must report the card s value on their Form W 2 as wages so they

Yes gift cards are taxable According to the IRS gift cards for employees are considered cash equivalent items Like cash include gift cards in an employee s taxable income regardless of how little the gift card value is Employers planning on giving gift cards this season should remember that the IRS regulations support treating all gift cards and gift certificates provided to an employee as taxable income

More picture related to Is Giving Employees Gift Cards Taxable

Gift Cards Become Taxable Income When Gifted To An Employee Be

https://i.ytimg.com/vi/V8GmzXtgec8/maxresdefault.jpg

10 Off Gift Cards For Tax Day Red Robin

https://www.redrobin.com/sites/default/files/2022-04/gift-cards-tax-day_0.jpg

35 Gift Money Letter Template Hamiltonplastering

https://hamiltonplastering.com/wp-content/uploads/2019/05/gift-money-letter-template-awesome-donation-receipt-letter-for-tax-purposes-template-gift-of-gift-money-letter-template.jpg

Are Gift Cards Taxable to Employees Gift cards given to employees in any amount count as taxable income and must be reported You must report the cash value of gift cards as part of an employee s wages on Gift cards for employees are not just a thoughtful way to show appreciation They re also considered taxable income by the IRS This matters because when you give gift

Gift cards are considered cash equivalent items and must be reported as taxable income They fall under the category of cash equivalent fringe benefits which means their Cash and gift cards are treated as direct compensation by the IRS making them fully taxable regardless of amount Employers must include their value in employees wages

California Payroll Conference Ppt Download

https://slideplayer.com/slide/14314981/89/images/10/Tips+When+Giving+Employees+Gifts.jpg

Gifts For Employees Sioux Eachelle

https://www.uniqueideas.site/wp-content/uploads/christmas-christmas-gift-ideas-for-employees-beautiful-25-unique.jpg

https://www.thetaxadviser.com › issues › apr › tax...

An employer can explore several avenues to potentially provide tax free gifts to employees but each comes with its own requirements to qualify for preferential tax treatment

https://accountinginsights.org › tax-implications-of...

Gift cards given to employees are generally considered taxable income and must be reported on their W 2 forms The IRS treats gift cards as cash equivalents meaning they

30 Best Employee Gifts Ultimate Corporate Gift Guide For 2021

California Payroll Conference Ppt Download

Gift Card Being Applied Inconsistently In Cart And Order cart Is

Gift Card Being Applied Inconsistently In Cart And Order cart Is

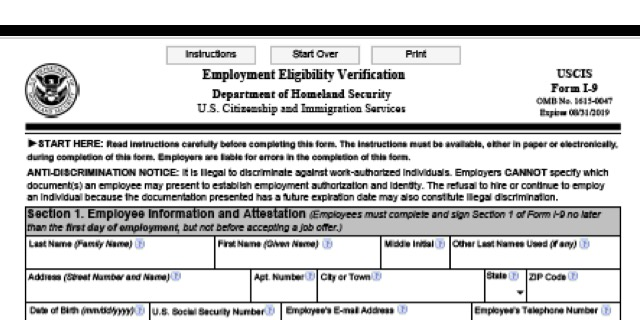

New Form I 9

Employee Gift Cards Taxable Lamoureph Blog

Employee Gift Cards Taxable Lamoureph Blog

Employee Gift Cards Taxable Lamoureph Blog

Teacher Appreciation Week List

Are Gift Cards Taxable IRS Rules Explained

Is Giving Employees Gift Cards Taxable - Yes gift cards are taxable According to the IRS gift cards for employees are considered cash equivalent items Like cash include gift cards in an employee s taxable income regardless of how little the gift card value is