Hmrc Scale Rate Expenses Payments Furthermore HMRC no longer accepts that a scale rate payment for this purpose should be agreed with an employer The travel rules still apply to actual costs of subsistence incurred

Expenses are paid or reimbursed in an approved way if they are paid using the HMRC Benchmark Scale Rates or using a bespoke rate agreed with HMRC and a checking system HMRC has updated its guidance to employers in relation to expenses and scale rate payments for subsistence and incidental overnight

Hmrc Scale Rate Expenses Payments

Hmrc Scale Rate Expenses Payments

https://op-kevytyrittaja.fi/media/pages/etusivu/e7e6bee88b-1718876116/screenshot-etusivu.png

Light Entrepreneurship With Or Without A Business ID OP Light

https://op-kevytyrittaja.fi/media/pages/etusivu/d5ed5284e3-1718876116/screenshot-alv-vero.png

Tutorials Archive MyManheim

https://d3foicfvjuk8pb.cloudfront.net/app/uploads/2023/10/How-to-Order-and-Floor-Plan-Transportation-at-Checkout-0000226.webp

Got a situation where a company wants to pay employees travelling overseas on business the benchmark scale rates published by HMRC HMRC guidance is silent though on What checks must an employer do when paying staff according to HMRC scale rates for subsistence in the UK including how frequently what sample size what if the

You can set up a scale rate payment by either agreeing a scale rate with HM Revenue and Customs HMRC by providing evidence of typical expenses for example receipts using HMRC s benchmark scale rates for HMRC s overseas scale rate was last updated in February 2019 In many cases it is no longer representative of the true cost of living abroad when travelling on business as those

More picture related to Hmrc Scale Rate Expenses Payments

Insurance Information The Well Counseling

http://static1.squarespace.com/static/64c41d172c48b91ae14abeb4/t/6528262013bc2002bc122c34/1697130016718/Art+Final.png?format=1500w

Top Accounting Software Comprehensive GST And Inventory Management

https://rkitsoftware.com/assets/img/Billing.png

Yin Restorative Yoga Series Meghan Johnston

https://images.squarespace-cdn.com/content/v1/5e83d750bb177535888520fc/1709780031782-9RA0H6J1K873F71CTRD7/image-asset.jpeg

Many employers pay or reimburse at scale rates expenses incurred by employees in performing their duties Subsistence payments are a common example Scale rate payments both for UK and international business travel offer a clear tax efficient way to reimburse employees for work related expenses Employers can choose

For tax years 2016 to 2017 onwards the benchmark scale rates have been revised and are now included within the exemption for amounts which would otherwise be deductible See Discover how HMRC s updated guidance on expenses and scale rate payments can benefit your business with tax free allowances sampling methods and international

Sample HMRC Letters Business Advice Services

https://businessadviceservices.co.uk/wp-content/uploads/2017/12/corporation-tax-arrears-redact.jpg

More Time To Pay VAT Alterledger

https://www.alterledger.com/wp-content/uploads/2020/09/HMRC-More-time-to-pay-deferred-VAT-20200923-scaled.jpg

https://www.gov.uk › hmrc-internal-manuals › ...

Furthermore HMRC no longer accepts that a scale rate payment for this purpose should be agreed with an employer The travel rules still apply to actual costs of subsistence incurred

https://assets.publishing.service.gov.uk › ...

Expenses are paid or reimbursed in an approved way if they are paid using the HMRC Benchmark Scale Rates or using a bespoke rate agreed with HMRC and a checking system

Jack Gascoynes

Sample HMRC Letters Business Advice Services

HMRC Simplified Expenses Explained

Flat Rate Expenses Irish Federation Of University Teachers

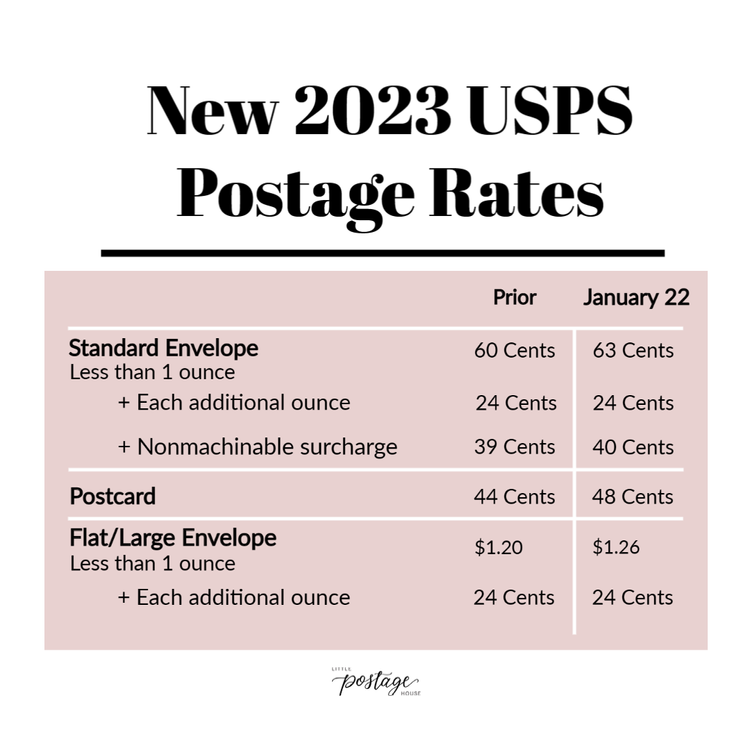

Usps Rates 2025 Eric I Thomas

Royal Mail Postage Rates 2024 Chart Susi Zilvia

Royal Mail Postage Rates 2024 Chart Susi Zilvia

Tax Brackets 2025 25 Richard D Hart

INDIAN OIL CORPORATION LIMITED NOTIFICATION

Mileage 2025 Irs Rates Stella Zoya

Hmrc Scale Rate Expenses Payments - What checks must an employer do when paying staff according to HMRC scale rates for subsistence in the UK including how frequently what sample size what if the