Can You Write Off Medical Expenses Taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their adjusted gross income The 7 5 threshold used to be 10 but legislative changes at the end of

Medical expenses include dental expenses and in this publication the term medical expenses is often used to refer to medical and dental expenses You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI Learn more about qualified medical costs and how much you can write off You can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on line 11 of your 2024 Form 1040

Can You Write Off Medical Expenses

Can You Write Off Medical Expenses

https://transform.octanecdn.com/crop/1300x700/https://octanecdn.com/oxygenfinancialcom/Can-you-write-off-medical-expenses-on-your-tax-return.jpg

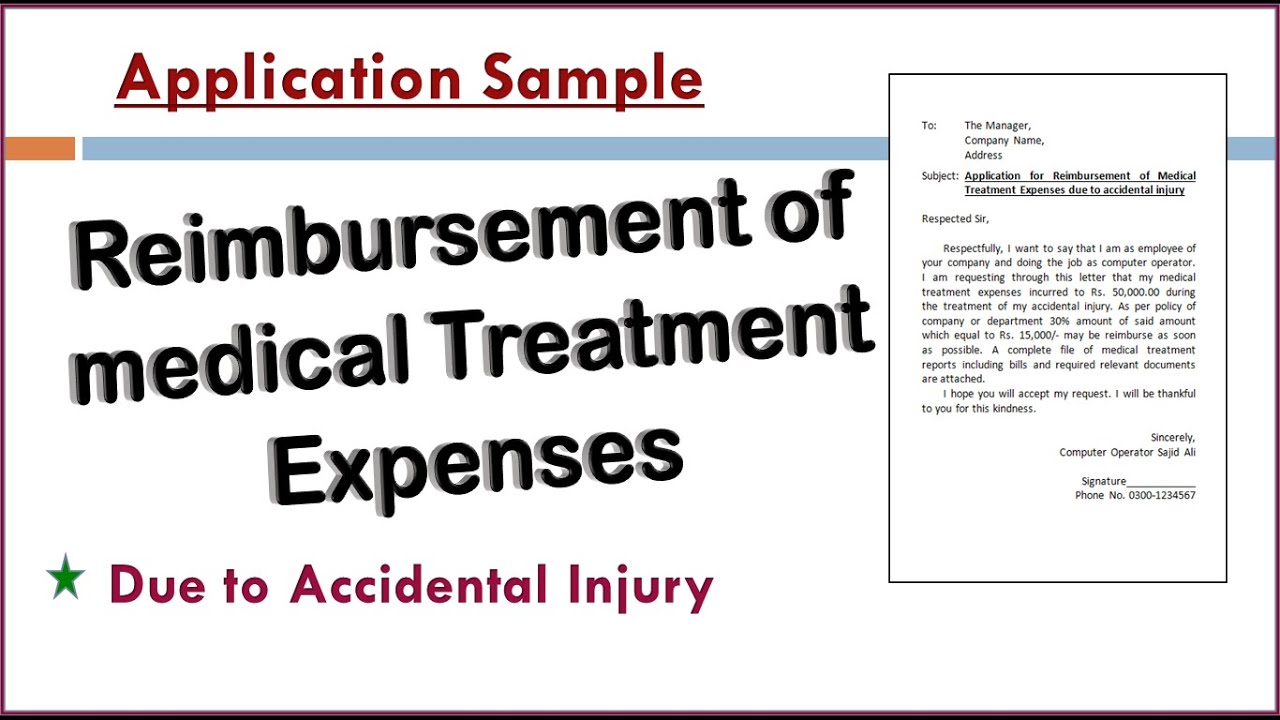

How To Write An Application For Reimbursement Of Medical Expenses Due

https://i.ytimg.com/vi/YzCZN8lNLm8/maxresdefault.jpg

The Best Way To Write Off Medical Expenses wealth investing business

https://i.ytimg.com/vi/nZ4IO-JL7so/oar2.jpg?sqp=-oaymwEkCJUDENAFSFqQAgHyq4qpAxMIARUAAAAAJQAAyEI9AICiQ3gB&rs=AOn4CLCbvFW5vvu9tIuidDr86lcpMf53Pg

To qualify as deductions expenses must be for preventing or treating a medical condition With the tax filing deadline approaching you might be trying to lower your income tax bill One often overlooked opportunity for savings is deducting medical expenses Many people take the standard deduction Deduct medical expenses on Schedule A Form 1040 Itemized Deductions The total amount of all allowable medical expenses is the amount of such expenses that exceeds 7 5 of adjusted gross income Can I deduct my medical and dental expenses My father is in a nursing home and I pay for the entire cost Can I deduct these expenses on my tax return

While you can receive a tax deduction for medical expenses in some cases that s not always true It s important to understand which medical expenses are tax deductible and which aren t so you re not incorrectly claiming expenses on your tax return Can I claim medical expenses on my taxes If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7 5 of your Adjusted Gross Income You can deduct the cost of care from several types of practitioners at various stages of care

More picture related to Can You Write Off Medical Expenses

Can You Write Off Medical Expenses On Your Taxes YouTube

https://i.ytimg.com/vi/Qt49Y50nFUo/oar2.jpg?sqp=-oaymwEkCJUDENAFSFqQAgHyq4qpAxMIARUAAAAAJQAAyEI9AICiQ3gB&rs=AOn4CLAhQ-M3dkAddSqj1JmfLCbZ9Z229g

Taxes You Can Write Off When You Work From Home INFOGRAPHIC

https://i.pinimg.com/originals/ec/37/83/ec3783c7fece82928ea9cba29cb7ad38.jpg

Sample Fundraising Letter For Medical Expenses Fundraising Letter

https://i.pinimg.com/736x/9e/bf/b7/9ebfb743a2e40e72b0988fdeb9d3b45f.jpg

Yes you can deduct only the amount that exceeds 7 5 of your adjusted gross income AGI for 2024 What are the rules for deducting medical expenses The rules for deducting medical expenses might seem overwhelming but they are straightforward You must claim any expenses the year you paid for them It s tempting to want to write off every pet expense but most pet related costs are considered personal and not deductible While medical expenses for a service animal might be deductible

[desc-10] [desc-11]

Write Off Medical Expenses Hollywoodkery

https://inspiredbudget.com/wp-content/uploads/2018/06/medical-expenses-checklist-image.png

Screenplay Format 101 Flashbacks Filmmaker Tools

https://www.filmmaker.tools/wp-content/uploads/sites/16/Filmmaker-Tools-Logo.svg

https://www.nerdwallet.com › article › taxes › medical...

Taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their adjusted gross income The 7 5 threshold used to be 10 but legislative changes at the end of

https://www.irs.gov › publications

Medical expenses include dental expenses and in this publication the term medical expenses is often used to refer to medical and dental expenses You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI

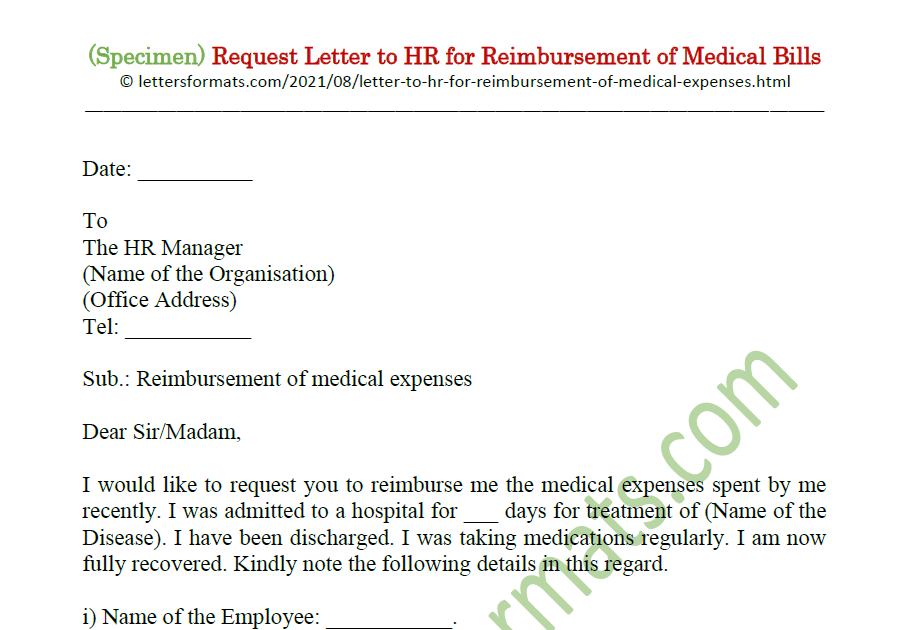

Reimbursement Letter Format

Write Off Medical Expenses Hollywoodkery

Write Off Medical Expenses Hollywoodkery

Realtor Deductions For Taxes

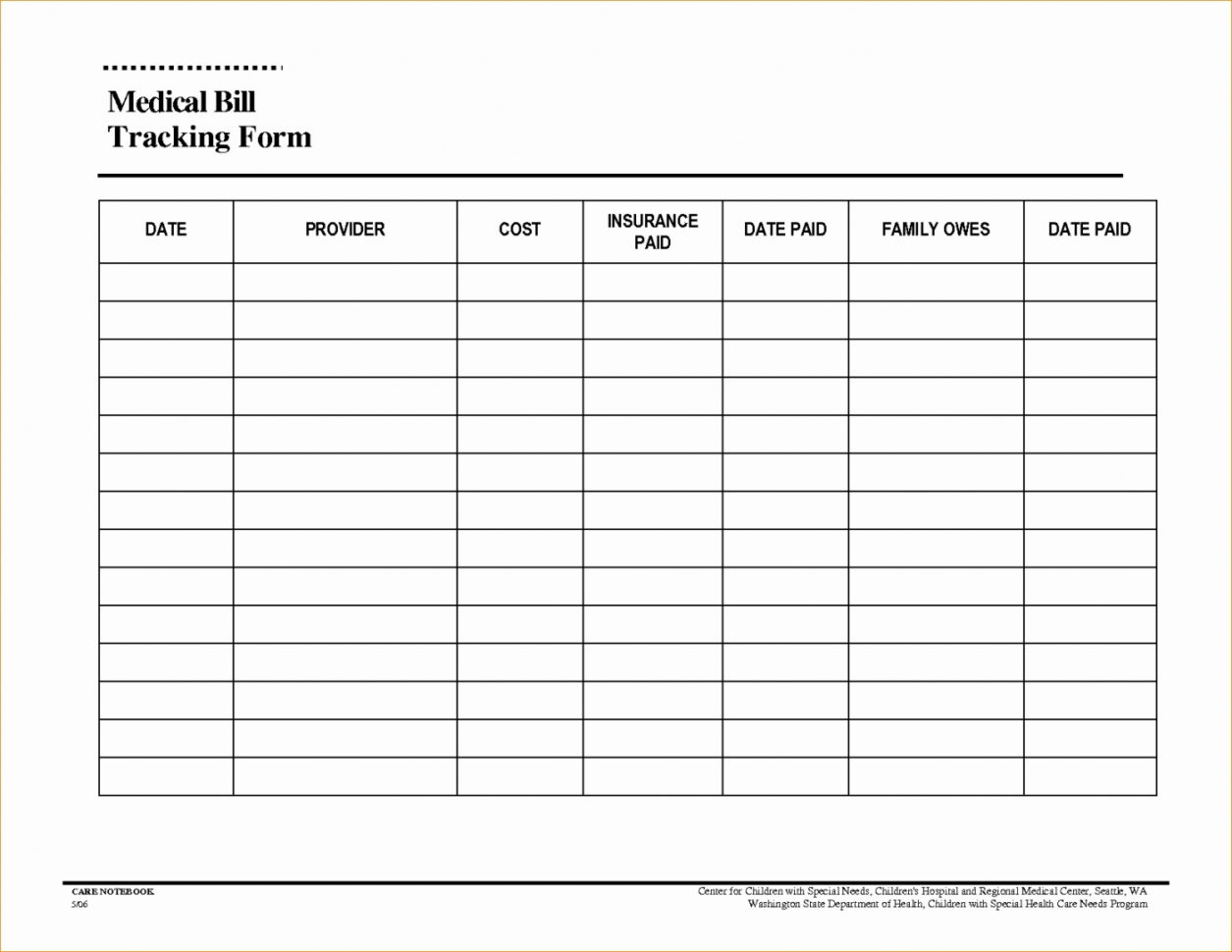

Medical Expense Spreadsheet Templates Db excel

Julia Austin MS RDN Posted On LinkedIn

Julia Austin MS RDN Posted On LinkedIn

Realtor Tax Deductions Worksheets

Hairstylist Tax Deductions Sheet

How To Write Off Medical Expenses Latimes Budgeting Medical Expensive

Can You Write Off Medical Expenses - [desc-13]