Can We Claim Dental Expenses In Medical Insurance Dental care is typically covered by dental insurance but in some cases medical insurance may pay for certain procedures when they are considered medically necessary

If you re able to claim your health insurance as a medical expense deduction you can only deduct medical Yes dental expenses are deductible as part of your overall medical expenses You can deduct the total amount you paid for dental care during the year if your expenses meet the requirements You typically cannot

Can We Claim Dental Expenses In Medical Insurance

Can We Claim Dental Expenses In Medical Insurance

https://i.pinimg.com/originals/37/18/aa/3718aad6f97268970012a9e4901a3007.png

Claim Examples In Writing 9 Sample Claims Letters 2019 02 16

https://images.sampletemplates.com/wp-content/uploads/2016/08/20141601/Claims-Letter-to-Insurance-Company.jpg

Fill Free Fillable Aflac Insurance PDF Forms ClaimForms

https://i0.wp.com/www.claimforms.net/wp-content/uploads/2022/09/fill-free-fillable-aflac-insurance-pdf-forms-1.png?fit=600%2C777&ssl=1

If you itemize your deductions on Form 1040 or 1040 SR Schedule A you may be able to deduct expenses you paid for medical care including dental for yourself your spouse and your Dental insurance premiums may be tax deductible The Internal Revenue Service IRS says that to be deductible as a qualifying medical expense the expenditures must be for procedures to

Health insurance rarely covers endodontic procedures because treating tissue inside your tooth is dental work The only medically necessary service could be an SBI General Insurance Company covers dental treatments under various health insurance plans To safeguard against unforeseen dental expenses and ensure comprehensive coverage you

More picture related to Can We Claim Dental Expenses In Medical Insurance

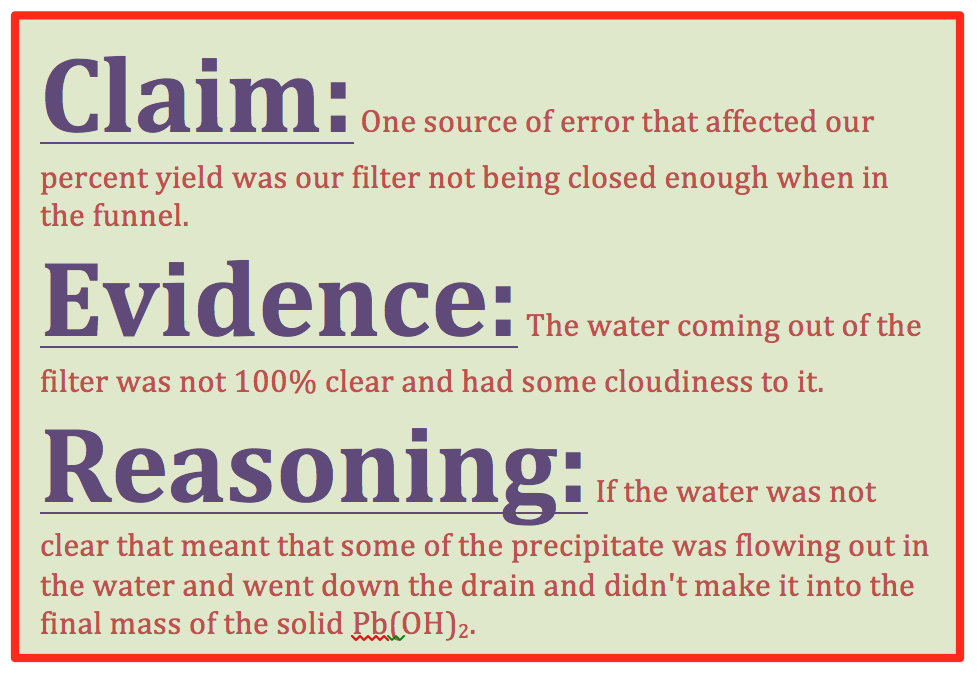

Claim Definition In Argumentative Writing

https://www.chemedx.org/sites/www.chemedx.org/files/images/article/implementing-claim-evidence-reasoning-framework-chemistry-classroom.png

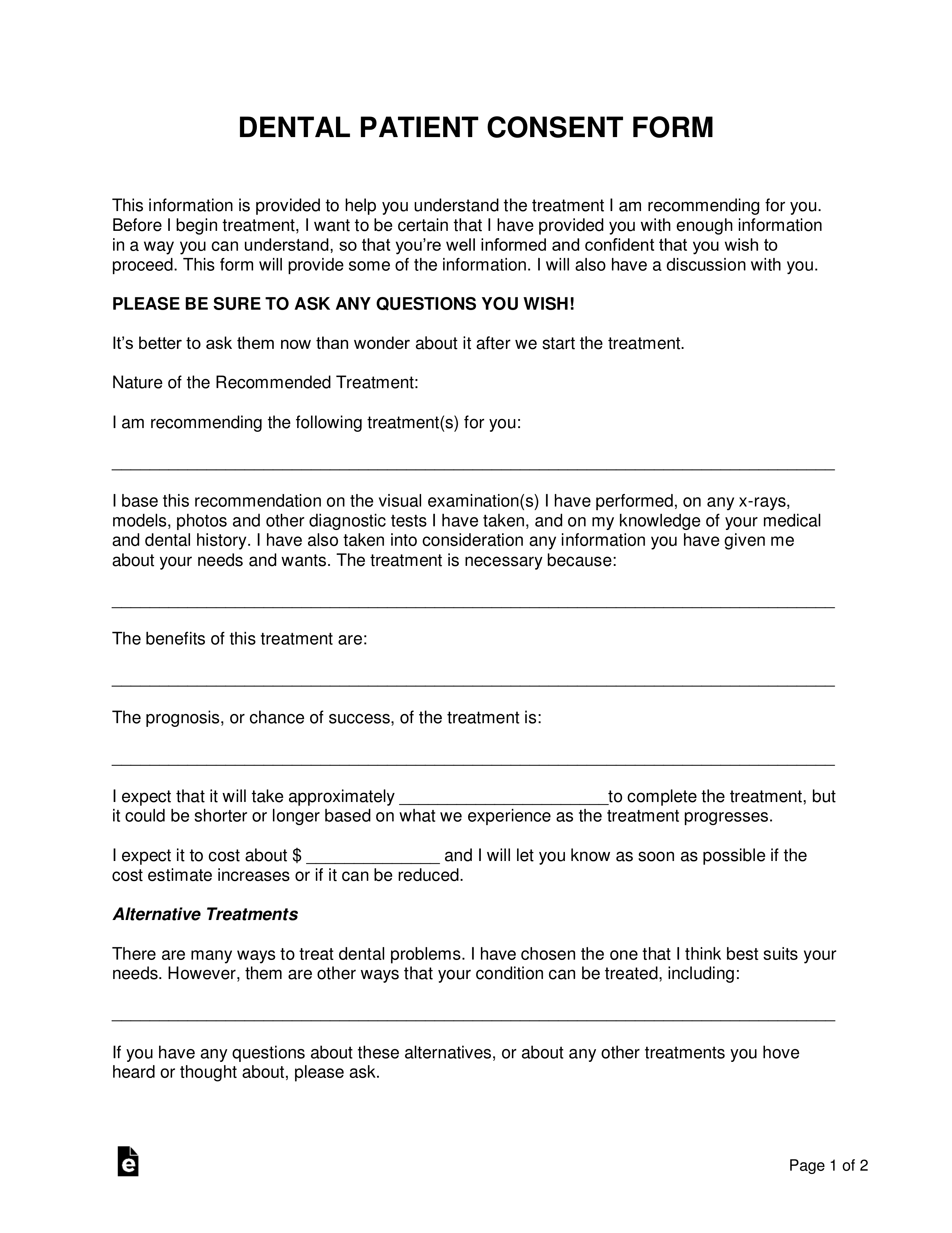

Printable Dental Treatment Consent Form

https://eforms.com/images/2017/08/Dental-Consent-Form.png

Health Insurance Claim Form Fill And Sign Printable Template Online

https://www.claimforms.net/wp-content/uploads/2023/08/health-insurance-claim-form-fill-and-sign-printable-template-online-1.png

If you itemize deductions you can deduct unreimbursed medical and dental expenses that exceed 7 5 of your adjusted gross income The IRS lets you deduct expenses for many medically necessary products and Yes if you are trying to claim the itemized deductions instead of the standard deduction you can include your health insurance Keep in mind your health insurance and all

Medical insurance typically covers dental procedures that are deemed medically necessary This usually means that the procedure is required to treat a health condition that impacts more than You can claim tax deductions for many dental procedures if they meet medical necessity requirements and exceed 7 5 of your adjusted gross income One Dental Billing guides

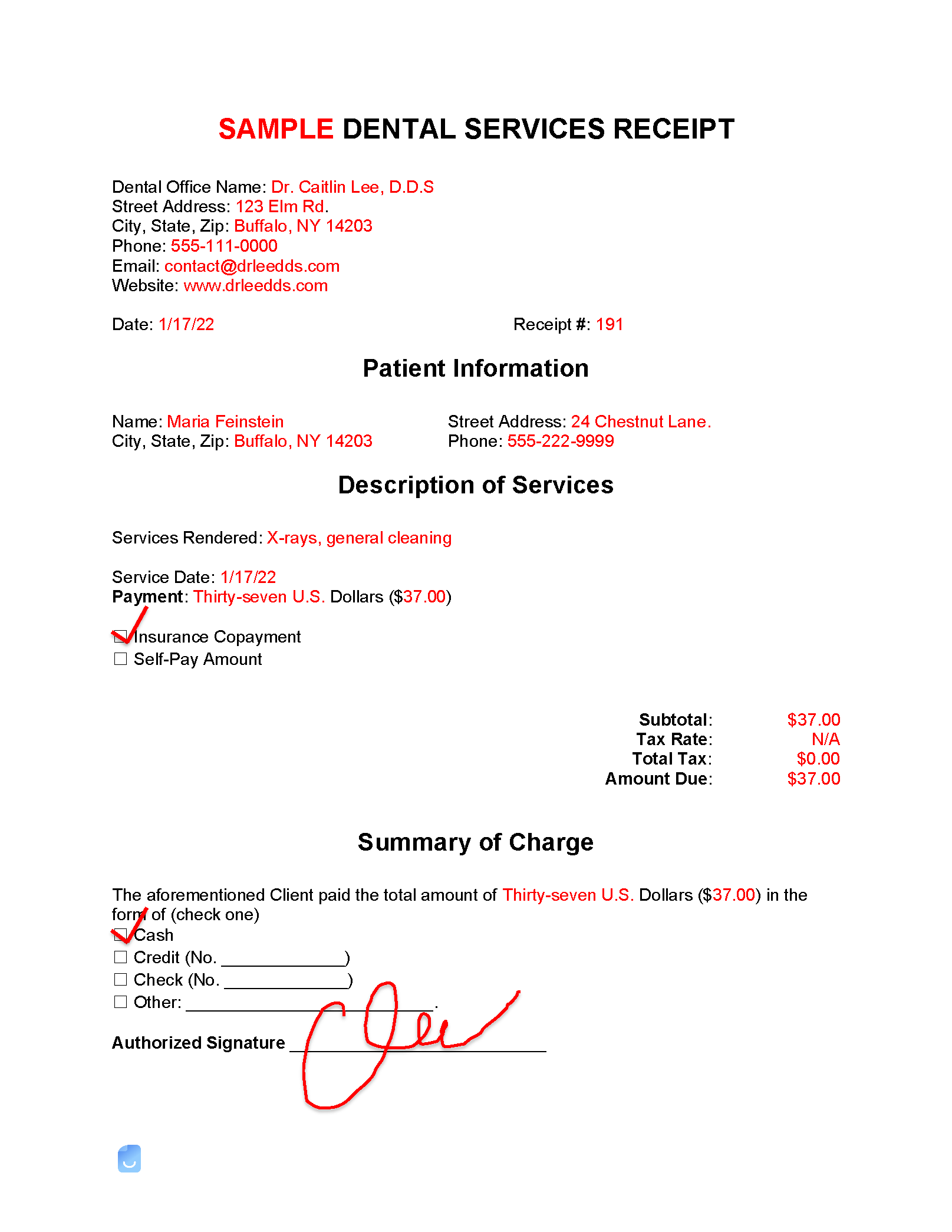

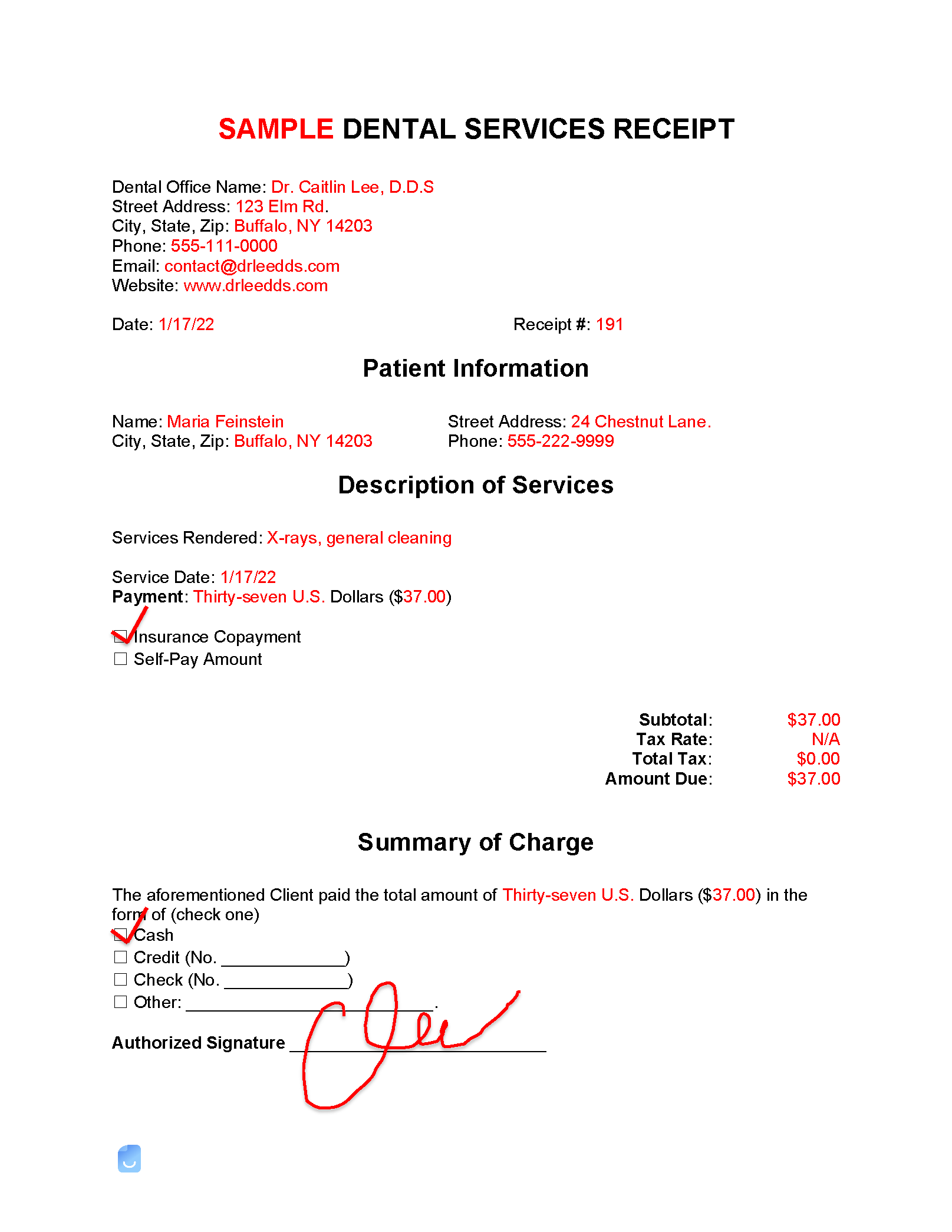

Dental Receipt Template Invoice Maker

https://invoicemaker.com/uploads/2022/11/SAMPLE-Dental-Receipt.png

Logo

https://dischemhealth.co.za/wp-content/uploads/2024/08/logo.png

https://legalclarity.org › what-dental-procedures...

Dental care is typically covered by dental insurance but in some cases medical insurance may pay for certain procedures when they are considered medically necessary

https://blog.turbotax.intuit.com › health-c…

If you re able to claim your health insurance as a medical expense deduction you can only deduct medical

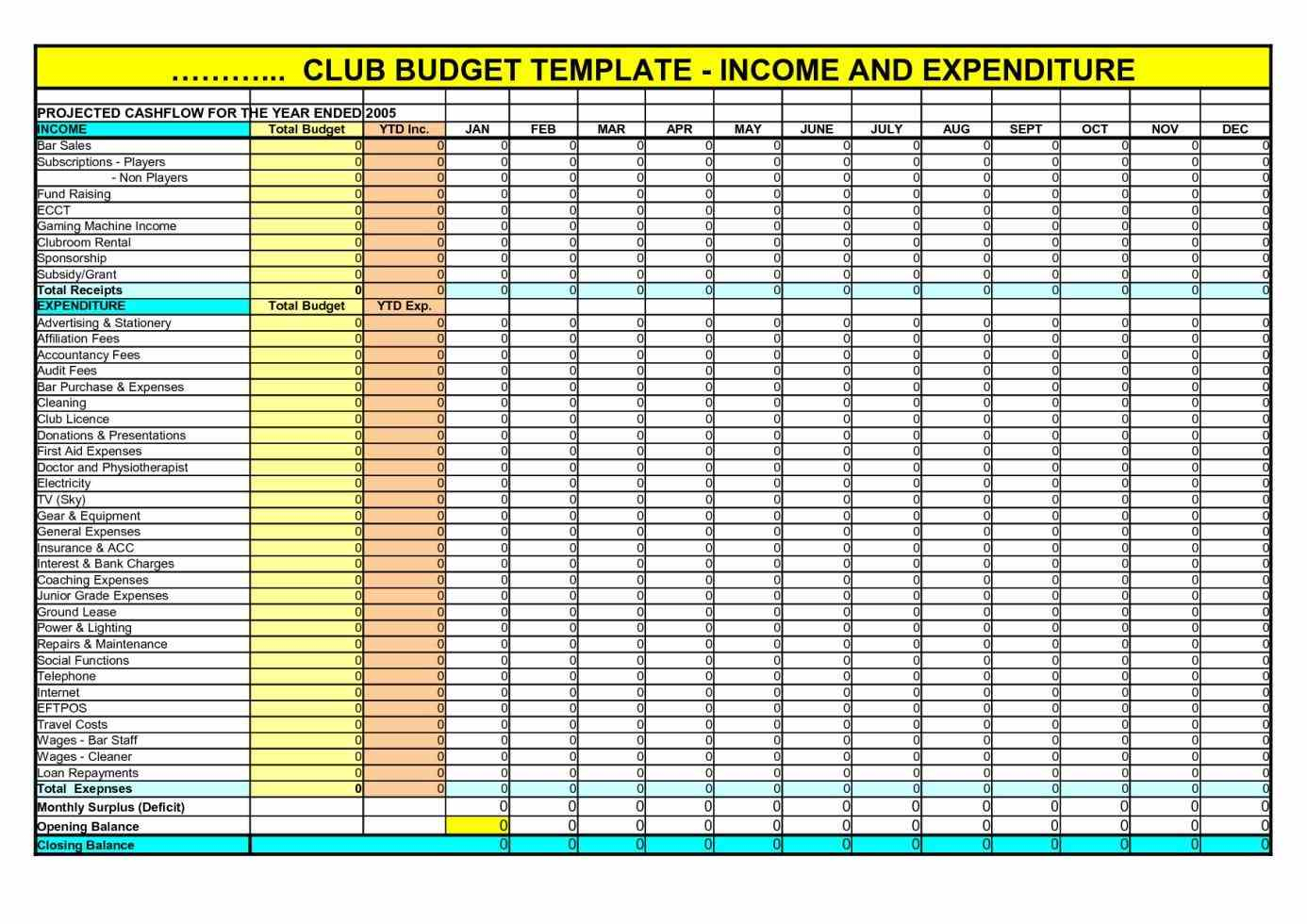

Business Tax Expenses Worksheet

Dental Receipt Template Invoice Maker

Claim Letter Template Printable Word Searches

Monthly Expenses List Printable

NFP Completes Acquisition Of Two Businesses In Strategic Moves

Dental Expenses Tax Deductible In Canada For Tax Payers KWC Dental

Dental Expenses Tax Deductible In Canada For Tax Payers KWC Dental

Fondo Juez En Concepto De Seguro M dico Foto E Imagen Para Descarga

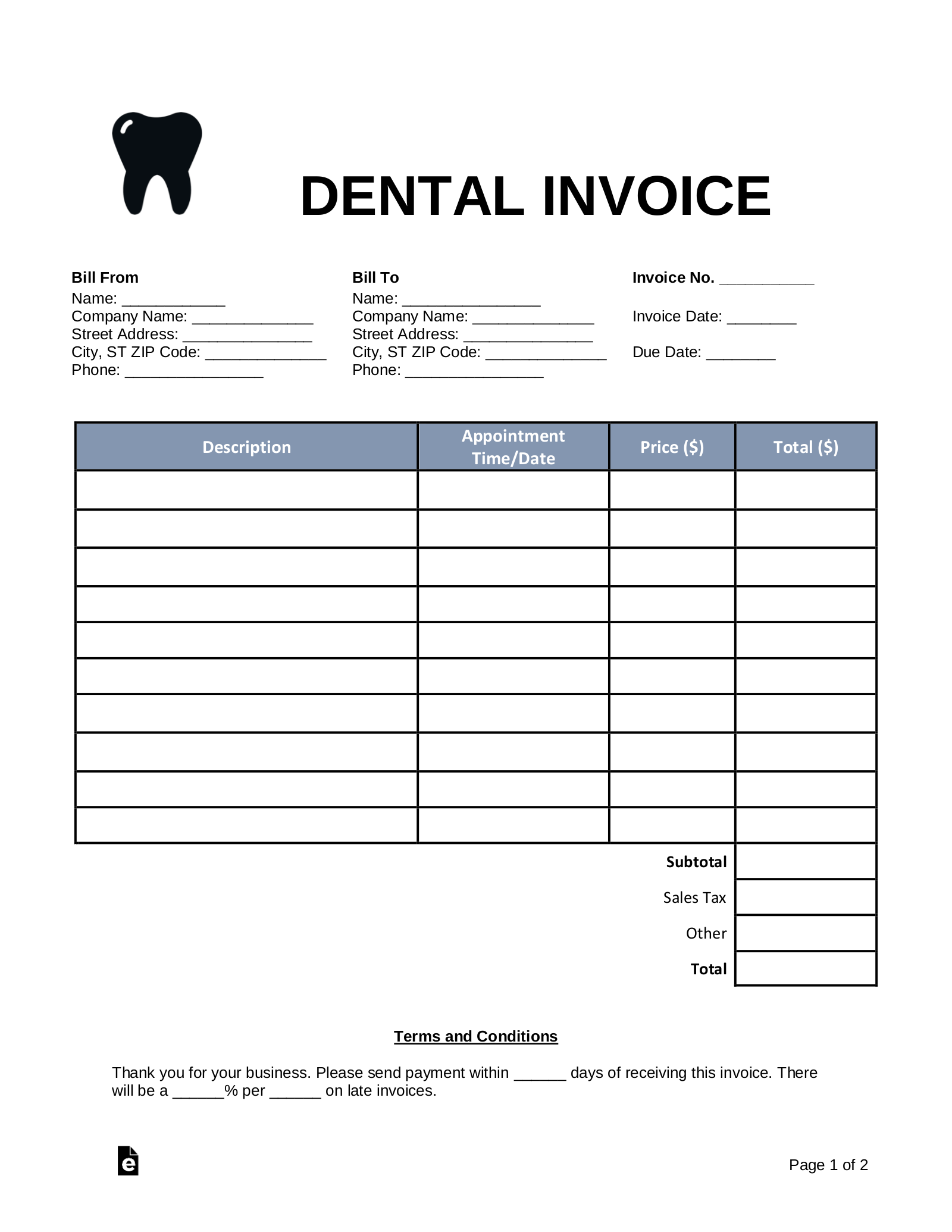

Free Blank Invoice Templates 30 PDF EForms

Wegovy Sample Letter

Can We Claim Dental Expenses In Medical Insurance - Generally you are allowed a deduction for most of the medical expenses that you paid during the tax year You can include Insurance premiums paid with after tax dollars Co pay amounts