Can I Claim Out Of Pocket Medical Expenses On My Tax Return However the money you paid out of your own pocket for your premiums might be tax deductible If you pay

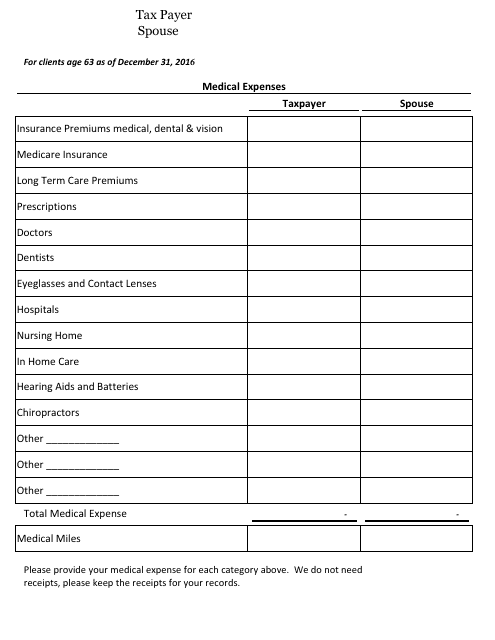

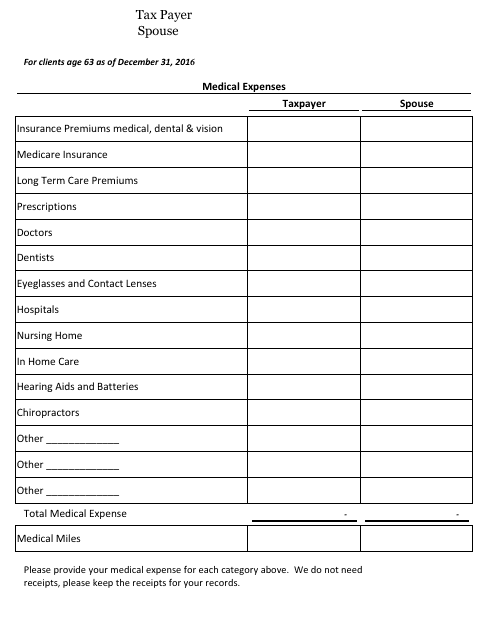

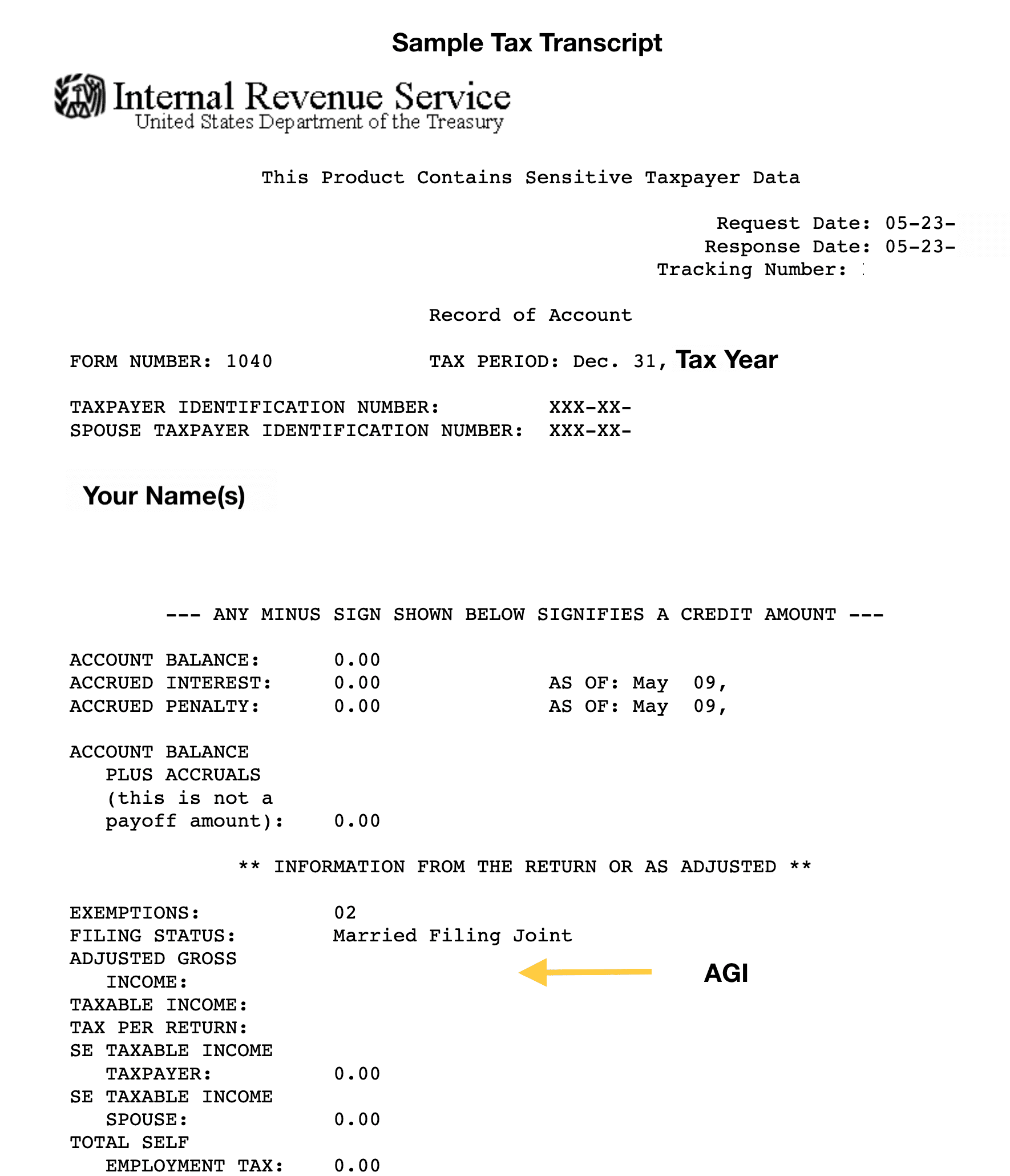

You won t be eligible to deduct all medical expenses on your tax return even if you itemize deductions You can deduct unreimbursed medical and dental expenses for you your spouse and dependents that exceed 7 5 of Taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their adjusted gross income The 7 5 threshold used to be 10 but legislative

Can I Claim Out Of Pocket Medical Expenses On My Tax Return

Can I Claim Out Of Pocket Medical Expenses On My Tax Return

https://data.templateroller.com/pdf_docs_html/269/2696/269632/medical-expenses-worksheet_big.png

Frequently Asked Questions PHSP HSA Smartin Benefits

https://www.smartinbenefits.com/images/faq/data-claim-medical-expenses-personal-tax.png

Expense Letter Samples

https://www.wordexceltemplates.com/wp-content/uploads/2020/07/Expense-Claim-Letter-to-Account-Office.png

Understanding which medical costs are eligible for tax deductions is crucial for maximizing returns and ensuring compliance with IRS regulations This article examines the Fortunately if you have medical bills that aren t fully covered by your insurance you may be able to take a deduction for those to reduce your tax bill We ll take you through which medical

This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses paid The year You can claim an itemized deduction for qualified medical expenses that exceed 7 5 of your adjusted gross income You can also take tax free health savings account HSA health care flexible spending account

More picture related to Can I Claim Out Of Pocket Medical Expenses On My Tax Return

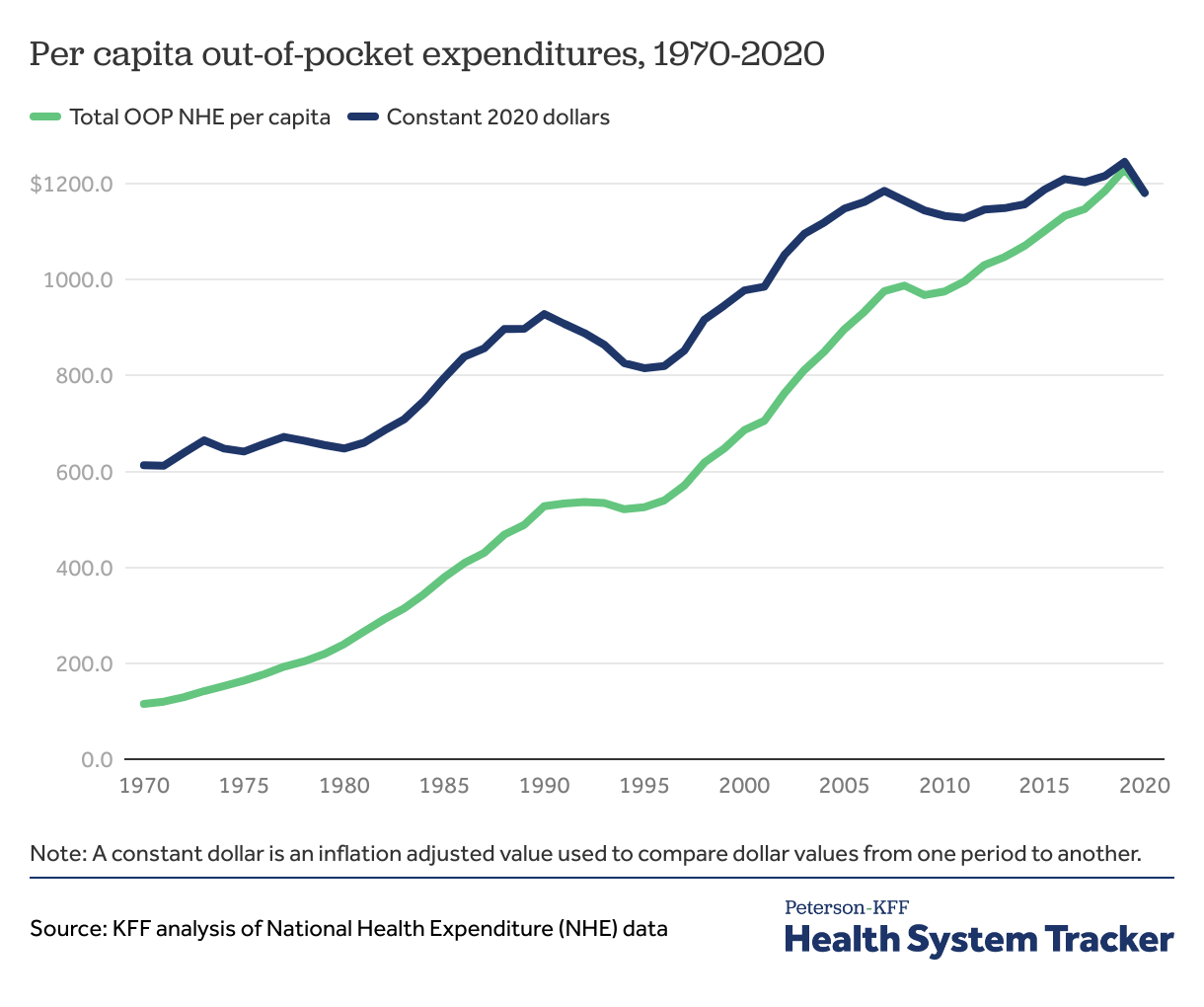

Out of pocket Spending Peterson KFF Health System Tracker

https://img.datawrapper.de/D2k7o/full.png

![]()

FREE Printable Medical Expenses Tracker World Of Printables

https://worldofprintables.com/wp-content/uploads/2021/06/printable-medical-expenses-tracker-template.jpg

Understanding Deductibles Co Pays Out of Pocket Maximums

https://www.internationalinsurance.com/wp-content/uploads/2015/01/insurance-deductibles-infographic.png

How do I claim the medical expenses on 2024 taxes To claim the medical expense deduction you must itemize deductions rather than take the standard deduction You If your unreimbursed out of pocket medical bills exceeded 7 5 percent of your adjusted gross income AGI you may be able to deduct them on your tax return

If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7 5 of your adjusted gross income You That means if you pay for an expense out of pocket but get reimbursed by your insurance company or anyone else you can t claim that expense as paid by you You may be able to

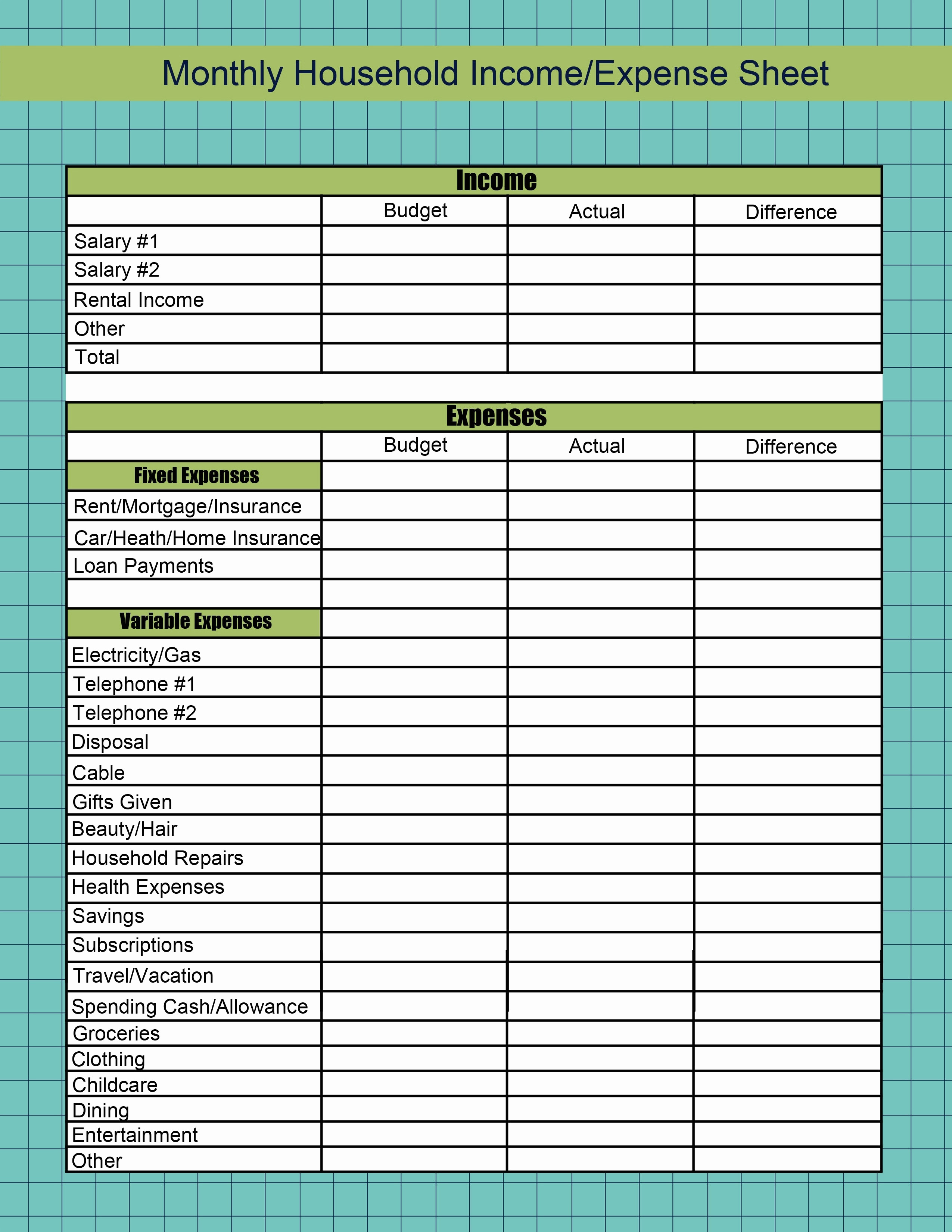

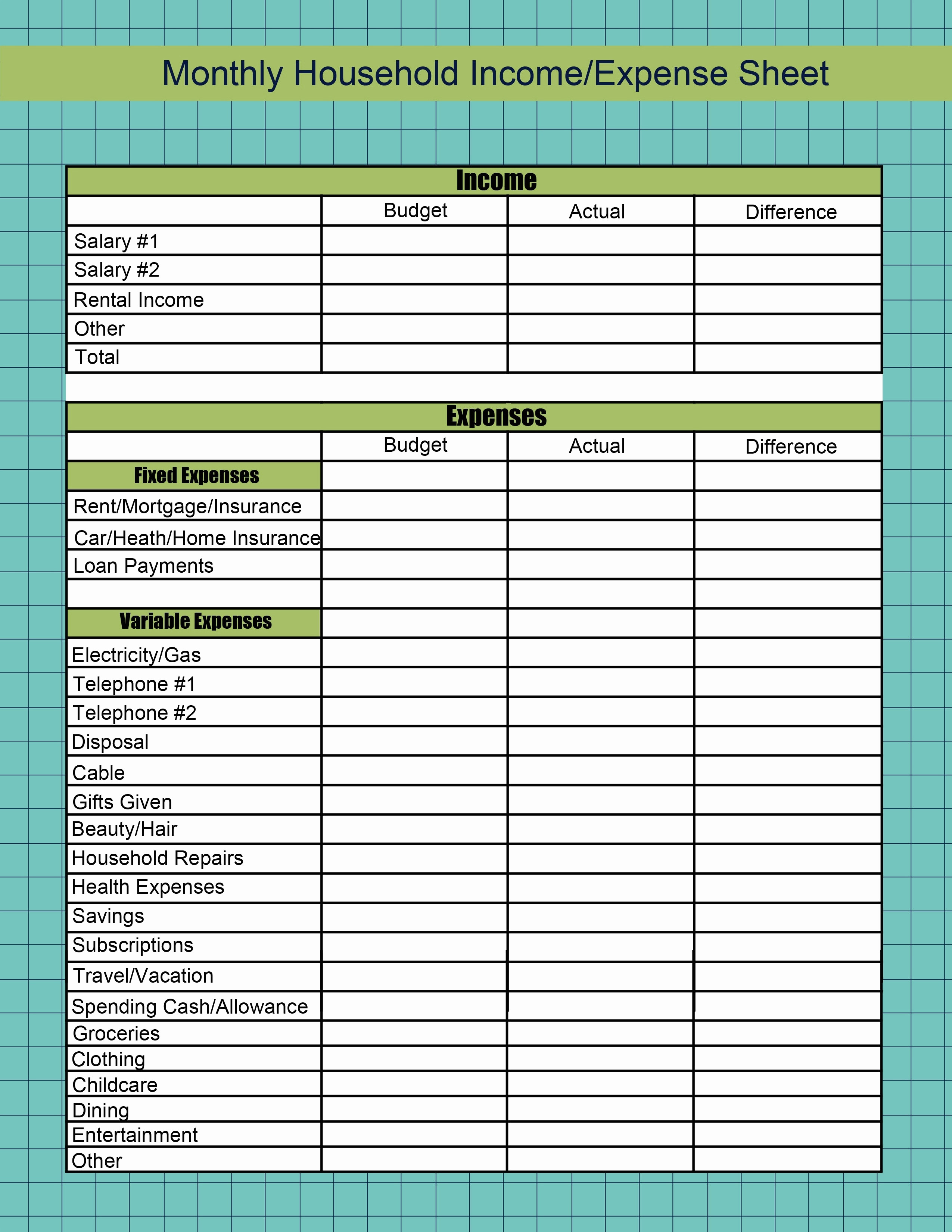

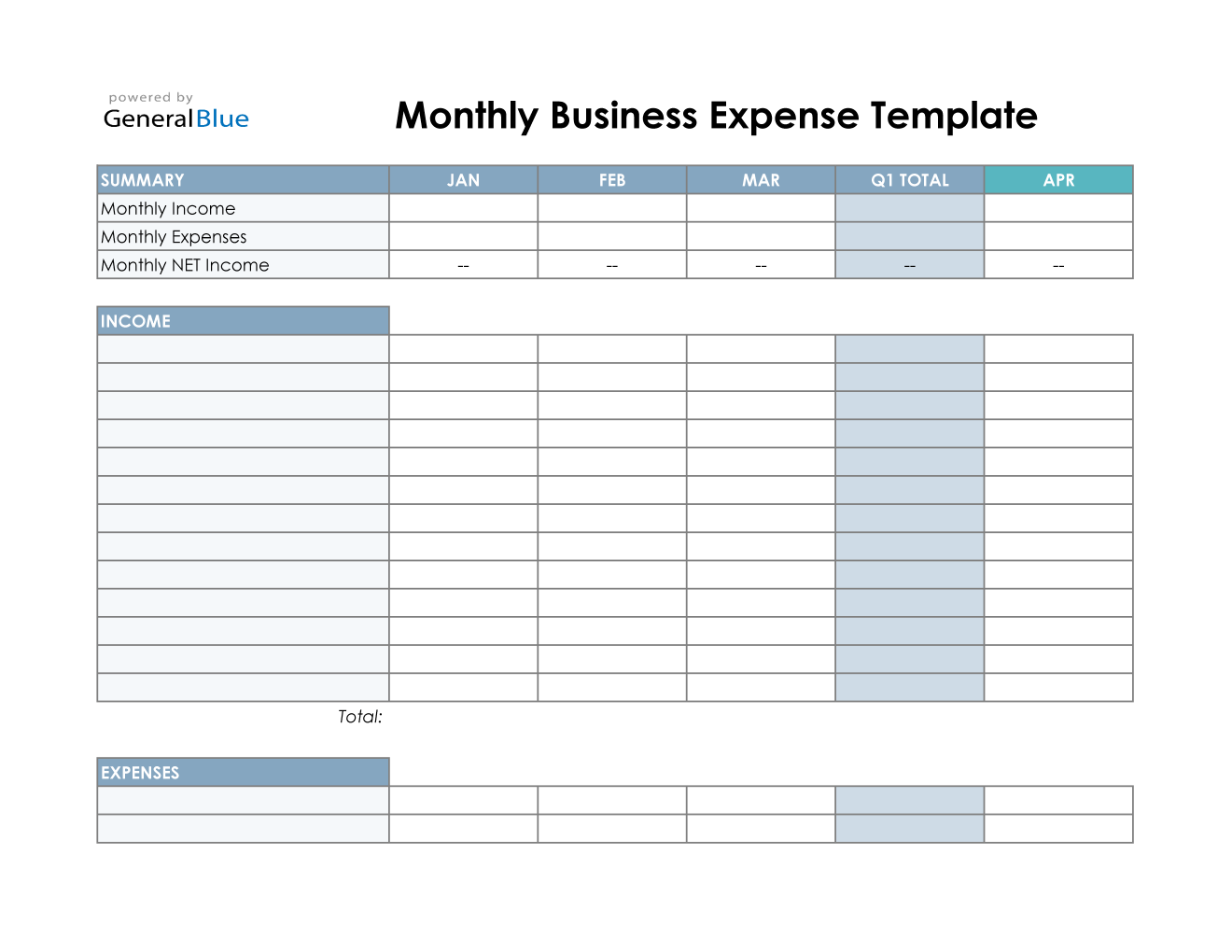

Income Expense Worksheets

https://db-excel.com/wp-content/uploads/2019/09/rental-property-income-expense-spreadsheet-debt-snowball.jpg

Can I Claim Medical Expenses On My Taxes TMD Accounting

http://tmdaccounting.com/wp-content/uploads/2017/08/Can-I-Claim-Medical-Expenses-on-My-Taxes-.png

https://blog.turbotax.intuit.com › health-c…

However the money you paid out of your own pocket for your premiums might be tax deductible If you pay

https://www.goodrx.com › ... › deductible-medical-expe…

You won t be eligible to deduct all medical expenses on your tax return even if you itemize deductions You can deduct unreimbursed medical and dental expenses for you your spouse and dependents that exceed 7 5 of

What Does Payout Mean

Income Expense Worksheets

Health Expenses Tax Deduction 2024 Ilsa Raquel

Monthly Expense Report Google Spreadsheets Rolfcap

Tax Return Transcript Sample

Medical Expense Tracker Individuals Can Use This Chart To Track

Medical Expense Tracker Individuals Can Use This Chart To Track

Real Estate Tax Deduction Sheet

Medical Expenses Nj Tax Return

Daily Expenses Worksheet

Can I Claim Out Of Pocket Medical Expenses On My Tax Return - Understanding which medical costs are eligible for tax deductions is crucial for maximizing returns and ensuring compliance with IRS regulations This article examines the